NYMEX natural gas is up $0.04 today, last trading at $2.72/MMBtu. The effect of shoulder season has begun to show itself in the fundamentals; power burn and ResComm are nearing the end of the week having both established clear downwards and upwards trends, respectively.

Participants will need to begin weighing the expected drop in demand to their outlook. What may offset this bearish factor is the state of LNG in the medium-term.

Beginning this past weekend, LNG and the Freeport terminal in particular showed stagnant feedgas demand, which analysts had speculated was an infrastructure issue; initial data today shows that Freeport is seeing a recovery, with increased movement of tankers at the terminal adding confidence to this thesis.

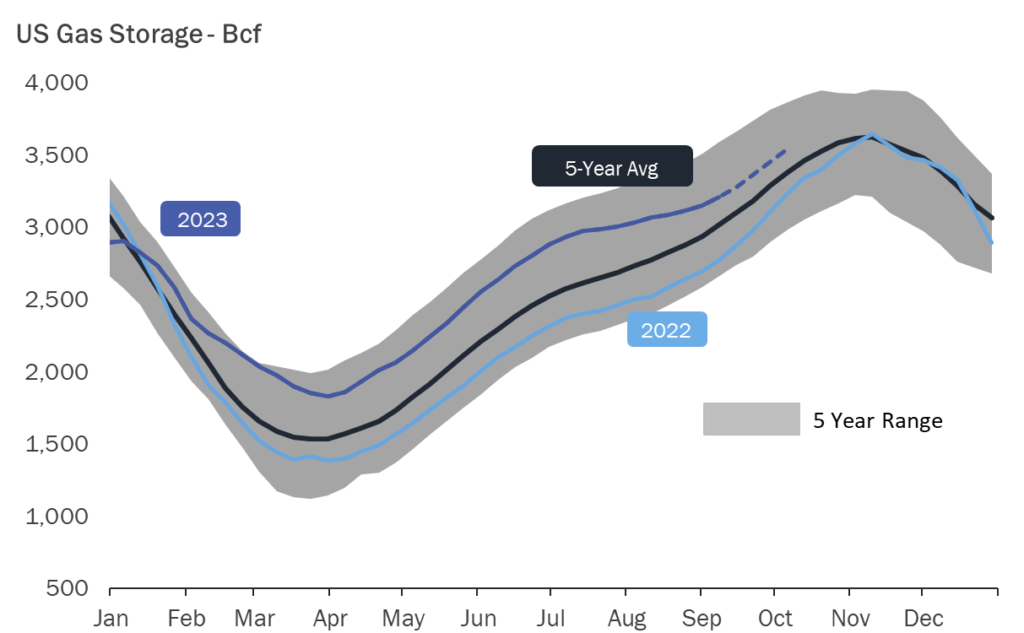

The EIA’s storage report this morning showed an injection of 57 Bcf for the week ending September 8, 2023. This was above market consensus and accordingly there has been a large retrace of what was previously a substantial rally this morning.

Despite this, injections of such size are fairly normal for this time of year, and when compared to both the last year and 5-year average injections, this is a relatively small one. This is reflected in the continually slimming surplus to the 5-year. Storage is now sitting 203 Bcf above the average of 3,002 Bcf.

Source: Gelber & Associates