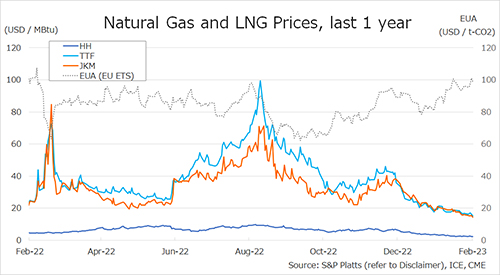

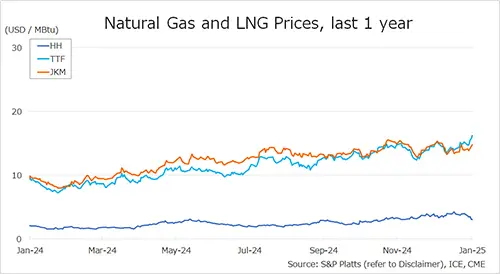

Henry Hub

Day change: $0.118, up 4.0% | Settle: $3.104 | July 2021

TTF

Day change: $0.422, up 4.7% | Settle: $9.332 | July 2021

JKM

Day change: $0.250, up 2.4% | Settle: $10.650| July 2021

Baker Hughes weekly gas-directed rig count of 98 (-1 w/w) as of 5/28 where 2 rigs were dropped in the Marcellus and another raised in “Other”

South Korea’s emissions trading scheme (KETS) is kicking in and kicking coal out, boosting gas-for-power demand and subsequently LNG demand. Looming hot weather and lower coal use in Korea is putting upward pressure on NE Asian spot LNG prices as well, rising above $11/mmBtu

China is out here setting records for the month of May with over 7 million tonnes of LNG imports per Kpler data, up ~25% from last May’s total of 5.8 million tonnes.

Beijing Gas Group has reportedly issued invitations for the expression of interest in supplying the group LNG for at least the duration of 2023 through 2032. As Beijing Gas Group is also currently developing a 5 mtpa LNG terminal in Tianjin, the invitations for supply are expected to be associated with the terminal

U.S. Sec of Energy Jennifer Granholm paid a visit to South Texas this past weekend, pronouncing the need for greener LNG and the use of CCS technology. While it ain’t easy being green, perhaps freedom gas will channel its inner-Kermit, “blending in with so many ordinary things”

Texas Eastern issued a force majeure for June after PHMSA declined TETCO’s attempt to renew an application to operate at max pressure on Line 10 & 15. The resulting FM has forced TETCO to operate at a 20% pressure restriction on that particular section of the pipeline.

Source: Tellurian