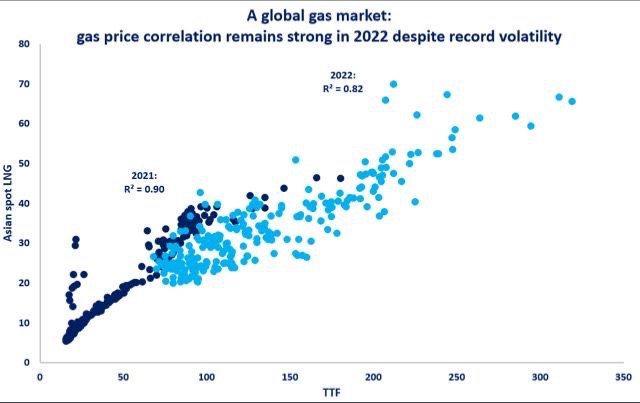

Despite all the wild price swings and record volatility, global gas price correlation remained strong in 2022, highlighting the increasingly globalised nature of gas trading.

The correlation between TTF and Asian spot LNG prices has certainly weakened compared to the previous years, to a factor of just 0.82.

This is still a very strong correlation, especially when taking into account that Europe was asymmetrically exposed to the Russian gas supply shock and volatility on TTF reached an unprecedented 250% after Russia started its brutal invasion against Ukraine.

This strong correlation highlights the increasingly globalised nature of gas trade and how key LNG demand centres -northeast Asia and Europe- influence each other, while fiercely competing for flexible LNG cargoes.

It will be interesting to see how this relationship will play out in the new year, especially now when JKM prices returned to a premium compared to TTF along the full 2023 forward curve…

Global LNG supply is expected to remain tight and competition for LNG could be stronger than expected, especially if China’s recovery takes-off.

What is your view? How will global LNG dynamics play out in 2023? Could we see stronger price correlation between TTF and JKM? What is your view on China’s LNG demand?