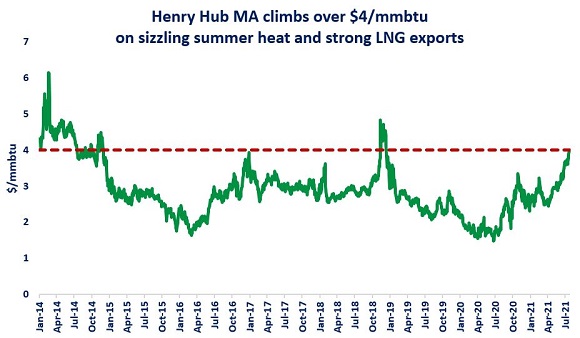

Magic four: Henry Hub MA climbed yesterday to over $4/mmbtu for the first time since Dec18, and reaching its highest July price since 2014.

How did we get there?

1. Sizzling summer heat is driving gas-fired powgen, up by 9% mom, especially in the Northwest, where low hydro levels support additional gas burn in the power sector;

2. Near record LNG exports: more than tripled since last year’s lows and up by 10% mom, driven by strong Asian demand and wide price spreads (~$10/mmbtu);

3. Let it flow to Mexico: strong demand recovery in Mexico supported record breaking US pipeline exports in June and 10% up yoy so far in July;

4. Production is recovering albeit not at speed with total demand+export growth, which is tightening market fundamentals and increasing the call on Canadian net imports;

5. Low storage: tight summer-winter spreads are weighing on storage injections, with inventory levels now 17% below last year’s levels.

What is your view? What is next for Henry? Could we see some correction in the coming months or summer bulls will remain in charge?

Source: Greg Molnar

See original post by Greg at LinkedIn.