How does a high-priced LNG environment impact LNG freight rates?

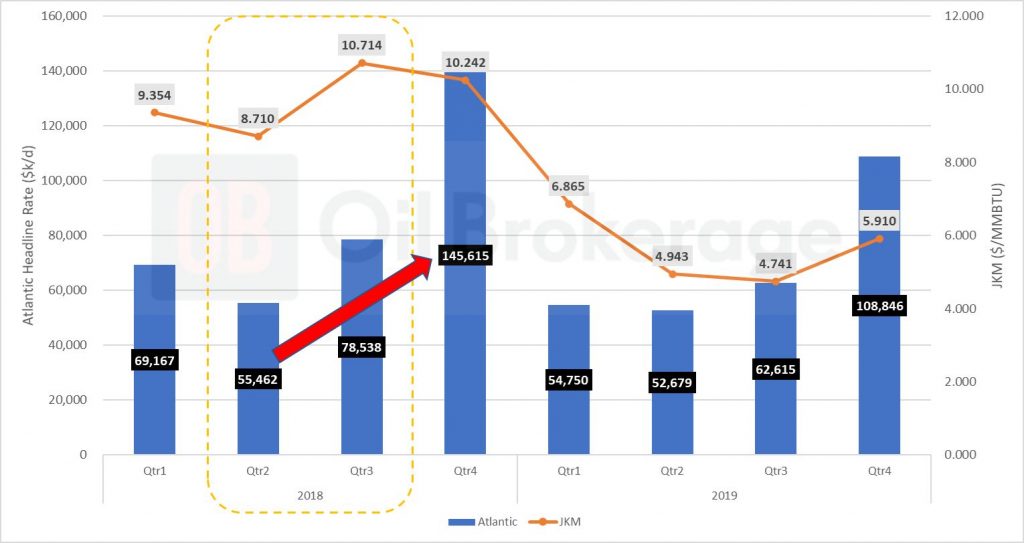

The last time we had summer JKM ~$8/MMBTU and what LNG freight rates looked like, and what happened in Q3 and Q4. The best recent reference is 2018.

Can see that LNG freight rates went from $55k/d to $78k/d in Q3 and then up 263% to $145k/d in Q4. This was despite JKM peaking in Q3 and softer in Q4. High JKM supports LNG freight because traders want to secure tonnage to deliver cargoes when prices are good.

Will the same happen this year? JKM and LNG shipping market dynamics are different compared with three years ago (more flexible US supply, significant fleet additions, Panama Canal congestion, etc) but it seems like we’re in for a volatile year for LNG freight and LNG FFAs.

Our clients receive these updates first. If you are interested, please contact me for a chat.

Source: Kwok Wan