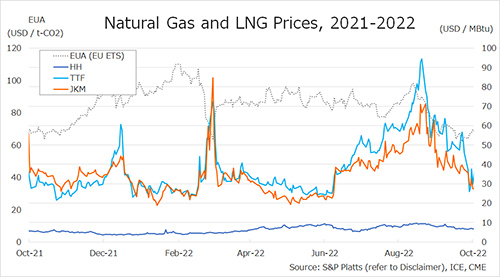

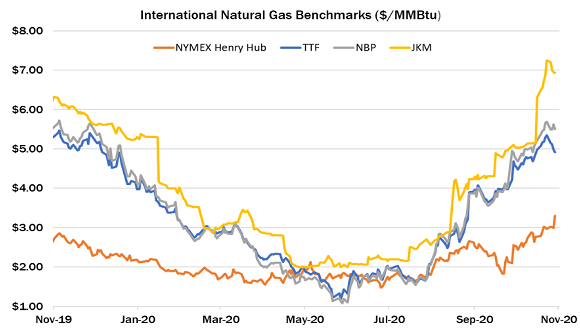

Supporting the high utilization rates at US LNG export facilities mentioned above is the return of healthy global demand going into the winter season, evidenced by climbing prices around the world.

Asia is the main driver of current strength, with the Japan-Korea Marker (JKM) benchmark impressively running as high as $7/MMBtu at times over the past week.

However, this isn’t the only region to exhibit a notable recovery, with the UK benchmark NBP and TTF in the Netherlands also trading in the $5-6/MMBtu range after collapsing below Henry Hub at times this past summer (see chart).

One other metric that demonstrates current tightness is the recent recovery in LNG spot charter rates, which have now topped $100,000/d for the first time in almost a year after running as low as 30,000/d over the summer.

The positive signs for the global market going into the coming winter suggest that there is still room for US LNG demand to grow in coming weeks, with upwards of 10 Bcf/d of capacity currently operating and a third train commissioning at Corpus Christi LNG.

Source: Gelber & Associates

Follow on Twitter: GelberCorp