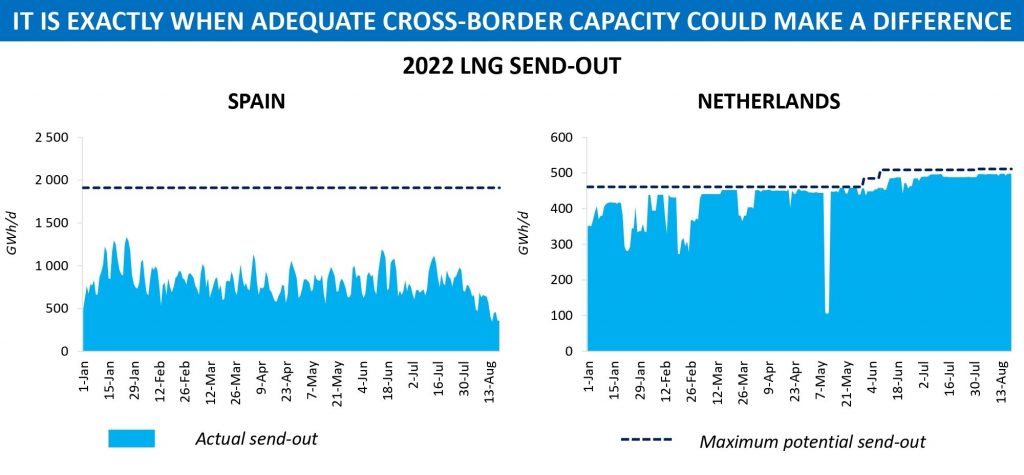

It is easy to be wise in retrospect, but just imagine how things could develop on the European gas market this year if all players had easy access to volumes sent from the region’s LNG terminals. The current natural gas crisis has just proved that it is not enough to be equipped with a number of regas facilities. To ensure energy security of the continent, they must also be supplemented by a well-developed system of cross-border connections.

Amid unprecedented spike in European gas hub prices, LNG imports into the region rose almost 60pc year-over-year in the first seven and a half months of 2022, according to Kpler. But if some points that connect LNG receiving countries with neighbouring market zones had had adequate capacity, this increase in cargo deliveries might have been even more significant.

If you check the utilization ratio of the Spanish import terminals, it best describes the problem of allocating regasified LNG between different market areas across the continent. While Spain accounts for nearly a third of Europe’s send-out capacity, the country’s regasification has been less than half of its potential level this year. Compared to 2021, physical gas flows from Spain to France of course increased considerably, but amounted on average to just 7 mcm/d between 1 January and 20 August 2022. All that is because the VIP Pirineos interconnection point lacks firm capacity to send much more ‘Spanish’ gas eastwards.

As you know, there is more than one such bottleneck in Europe. Take for instance the Obergailbach-Medelsheim point on the French-German border, or the Bacton exit capacity limitations.

The transport infrastructure issue becomes especially visible when compared to the region´s market zones, where LNG import facilities are used to full capacity thanks to the extensive network of cross-border points that those countries have. Among them, for example, is the Gate LNG terminal in the Netherlands that has been operating at about 90pc capacity in 2022, the ALSI data shows.

So, looking at the situation with cross-border capacity in Europe, once again you make sure the proverbial ‘miser pays twice’. Not investing adequately in interconnection capacity projects in previous years, one just had to pay much more now.

Source: Yakov Grabar (LinkedIn)