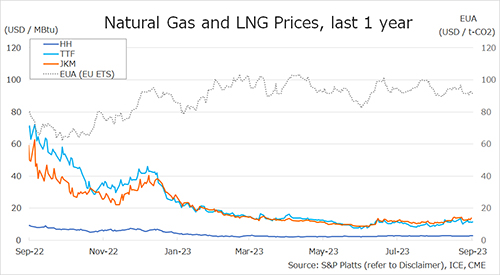

The Northeast Asian assessed spot LNG price JKM for last week (6 May – 10 May) increased to high-USD 10s on 10 May from middle-USD 10s the previous weekend.

The price was a downward trend in the first half of the week due to weak demand and high inventories but increased in the second half of the week due to heat wave in Southeast Asia, South Asia and demand for summer season.

METI announced on 8 May that Japan’s LNG inventories for power generation as of 28 April stood at 2.13 million tonnes, up 0.08 million tonnes from the previous week and as of 5 May stood at 2.01 million tonnes, down 0.12 million tonnes from the previous week.

The European gas price TTF for last week fell to USD 9.5/MBtu on 10 May from USD 9.6/MBtu the previous weekend. European gas price rose to USD 10.1/MBtu in the beginning of the week due to trouble at Gorgon LNG, but fell to USD 9.5/MBtu later in the week due to warm weather and high inventories.

According to AGSI+, the EU-wide underground gas storage increased to 64.4% as of 10 May from 63.1% the previous week.

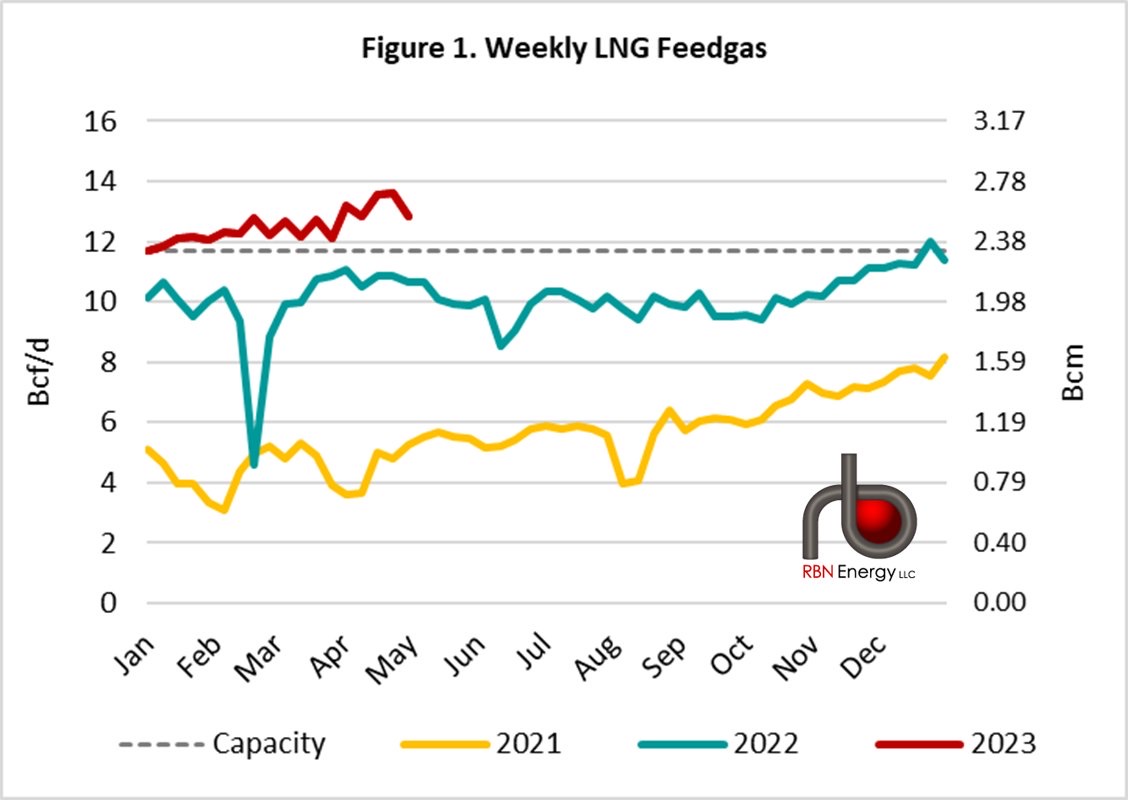

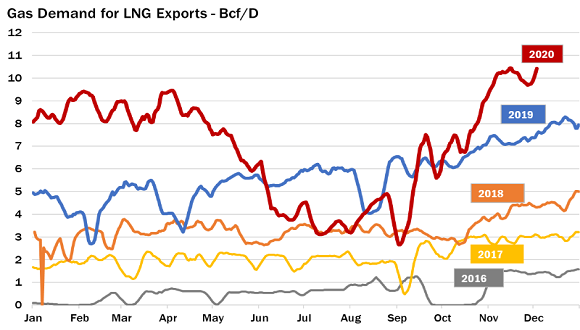

The U.S. gas price HH for this week slightly increased to USD 2.3/MBtu on 10 May from USD 2.1/MBtu the previous weekend. HH rose briefly in the second half of the week as feed gas supplies to major US liquefaction terminals rose, but fell due to solid inventories on 10 May.

The EIA Weekly Natural Gas Storage Report released on 9 May showed U.S. natural gas inventories as of 26 April at 2,563 Bcf, up 79 Bcf from the previous week, up 21.0% from the same period last year, and 33.3% increase over the five-year average.

Updated: 13 May 2024

Source: JOGMEC