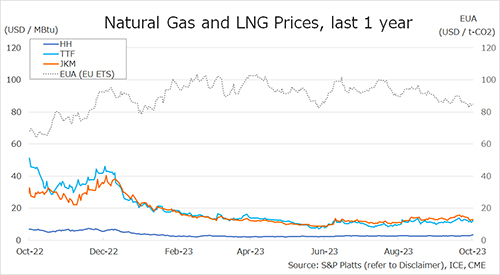

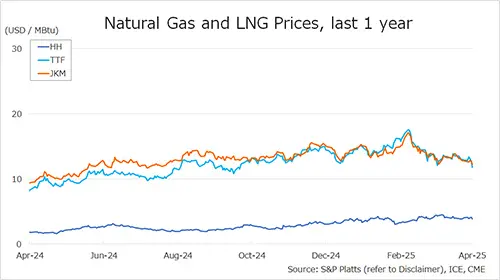

The Northeast Asian assessed spot LNG price JKM (May delivery) for last week (31 March – 4 April) fell to low-USD 12s on 4 April from high-USD 12s the previous weekend (28 March).

After a modest move in the first half of the week before the U.S. tariff announcement, the price fell to its lowest in eight months as concerns over the impact of it on the macroeconomy later in the week. METI announced on 2 April that Japan’s LNG inventories for power generation as of 30 March stood at 2.24 million tonnes, up 0.41 million tonnes from the previous week.

The European gas price TTF (May delivery) for last week (31 March – 4 April) fell to USD 11.8/MBtu on 4 April from USD 12.8/MBtu the previous weekend (4 April).

TTF fell after rising earlier in the week due to uncertainty ahead of the U.S. tariff announcement, followed by concerns of an economic recession and continued weakness in fundamentals such as rising temperatures and stable supplies from the Norwegian continental shelf.

According to AGSI+, the EU-wide underground gas storage was 34.6% on 4 April, up from 33.6% the previous weekend, down 42.0% from the same period last year, and down 23.4% over the five-year average. Since 28 March, the rate of underground gas storage EU-wide has been increasing.

The U.S. gas price HH (May delivery) for last week (31 March – 4 April) rose to USD 3.8/MBtu on 4 April from USD 4.1/MBtu the previous weekend (28 March). HH hovered around USD 4 throughout the week amid uncertainty over tariffs and temperature fluctuations throughout the week.

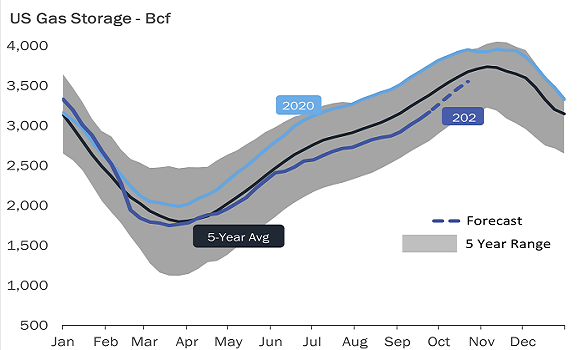

The EIA Weekly Natural Gas Storage Report released on 3 April showed U.S. natural gas inventories as of 28 March at 1,773 Bcf, up 29 Bcf from the previous week, down 21.7% from the same period last year, and 4.3% decrease over the five-year average.

Source: JOGMEC