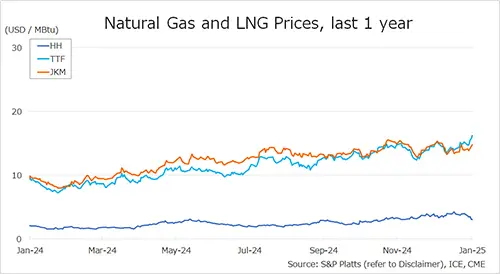

The Northeast Asian assessed spot LNG price JKM (March delivery) for last week (27 – 31 January) rose to high-USD 14s on 31 January from high-USD 13s the previous weekend (24 January). JKM prices fell slightly in the first half of the week as high inventories and high price levels continued to suppress demand.

However, for the week as a whole, the price rose on the 31 January on supply concerns due to continued cargo outflows to Europe. METI announced on 29 January that Japan’s LNG inventories for power generation as of 26 January stood at 2.15 million tonnes, down 0.16 million tonnes from the previous week.

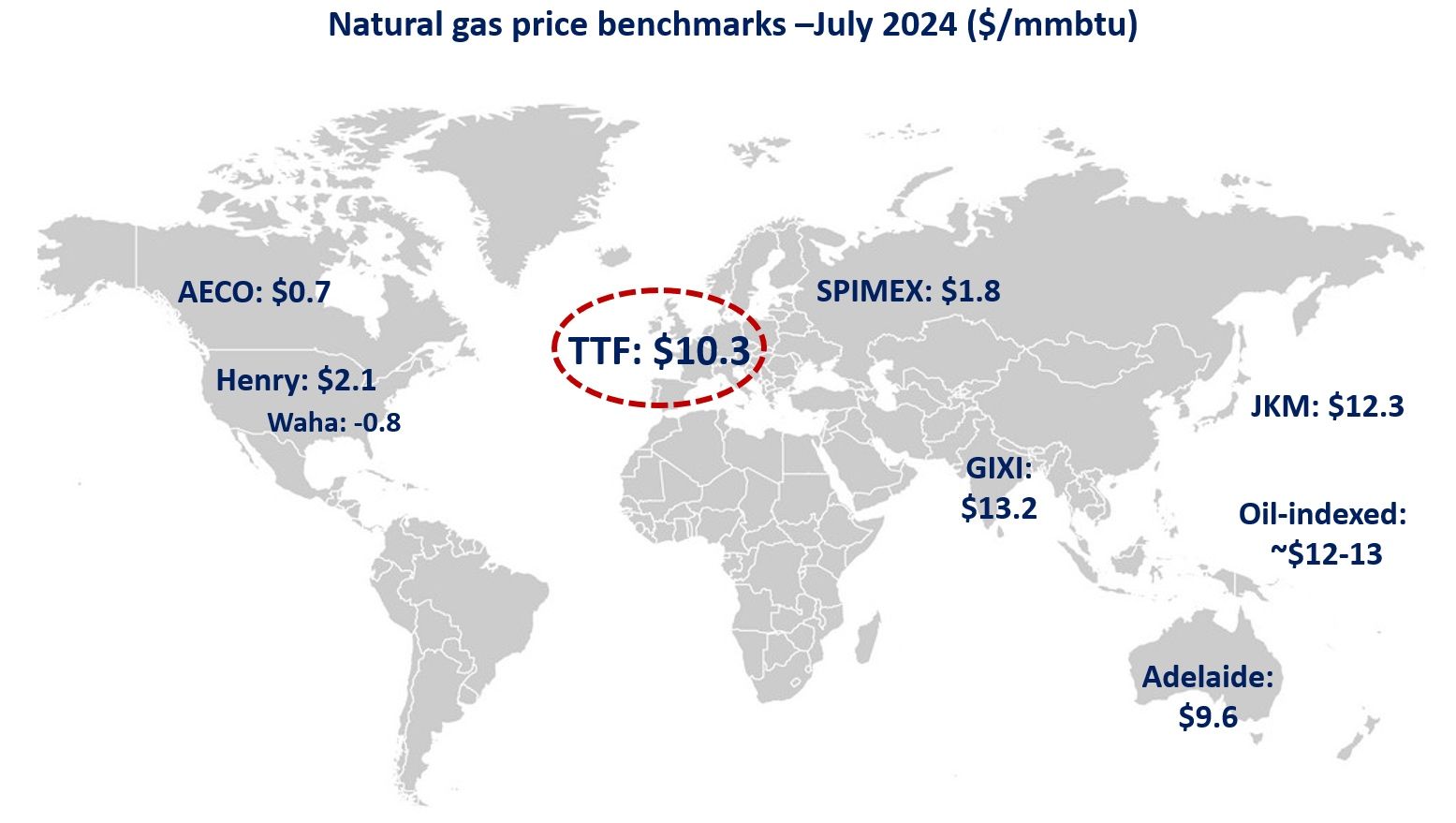

The European gas price TTF for last week (27 – 31 January) rose to USD 16.2/MBtu on 31 January (March delivery) from USD 15.3/MBtu the previous weekend (24 January, February delivery). TTF rose throughout the week due to continued forecasts of cooler temperatures and lower wind power output across the Europe.

According to AGSI+, the EU-wide underground gas storage was 53.6% on 31 January, down from 56.5% at the end of the previous weekend, down 23.1% from the same period last year, and down 9.8% over the five-year average.

The U.S. gas price HH for last week (27 – 31 January) fell to USD 3.0/MBtu on 31 January (March delivery) from USD 4.0/MBtu the previous weekend (24 January, February delivery). HH was on a downward trend throughout the week as heating demand continued to decline through mid-week and the forecast for a mild winter in February continued.

The EIA Weekly Natural Gas Storage Report released on 30 January showed U.S. natural gas inventories as of 24 January at 2,571 Bcf, down 321 Bcf from the previous week, down 5.3% from the same period last year, and down 4.1% over the five-year average.

Updated: February 3

Source: JOGMEC