Updated 28 August 2023

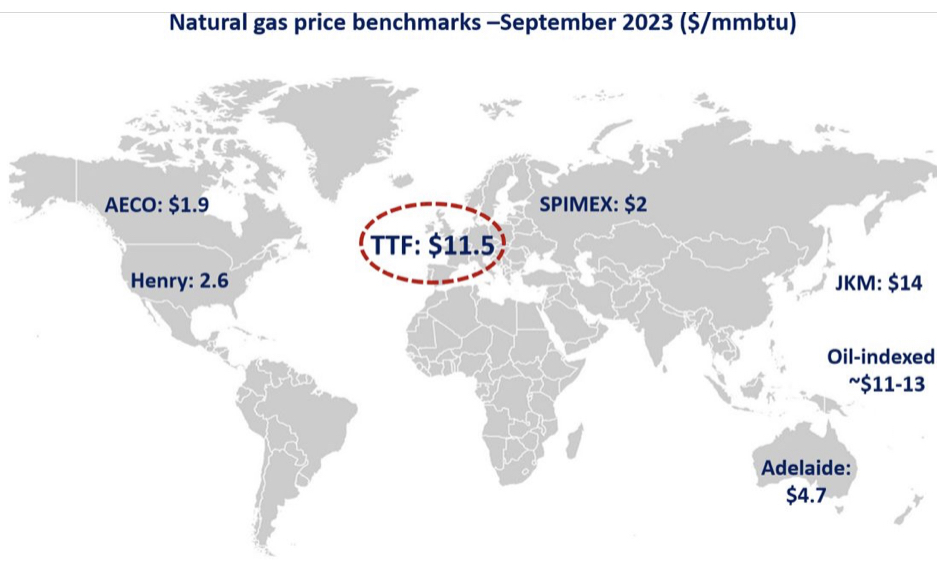

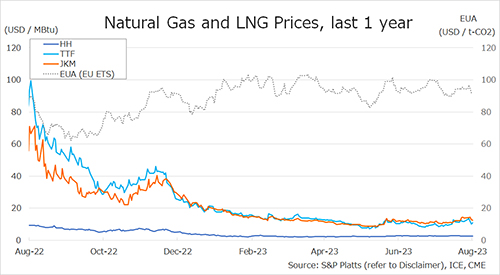

The Northeast Asian assessed spot LNG price JKM for the previous week (21-25 August) rose to low USD 14s on 23 August from high USD 13s due to uncertainty over supply concerns related to strikes at major projects in Australia. JKM then fell to the low USD 12s on 25 August amid eased uncertainty over the strikes in Australia.

METI announced on 23 August that Japan’s LNG inventories for power generation totaled 1.81 million tonnes as of 20 August, down 0.13 million tonnes from the previous week, down 0.94 million tonnes from the end of the same month of last year and down 0.19 million tonnes from the average of the past five years.

The European gas price TTF rose to USD 13.7/MBtu on 22 August from USD 11.6/MBtu the previous week as supply and demand tightened ahead of rising temperatures in southern Europe, concerns over a strike in Australia, and scheduled maintenance at the Norwegian gas field. TTF then fell to USD 11.0/MBtu on 25 August on eased uncertainty over the strike in Australia.

ACER published the 25 August spot LNG assessment price for delivery to the EU at EUR 34.8/MWh (equivalent to USD 11.0/MBtu). According to AGSI+, the European underground gas storage rate as of 25 August was 92.1%, up from 90.7% the previous week.

The U.S. gas price HH was almost unchanged USD 2.5/MBtu on 25 August from USD 2.6/MBtu the previous week, with some ups and downs. According to the EIA Weekly Natural Gas Storage Report released on 24 August, the U.S. natural gas underground storage on 18 August was 3,083 Bcf, up 18 Bcf from the previous week, up 20.0% from the same period last year, and up 9.5% from the average of the past five years.

Source: JOGMEC