Russian gas exports (pipeline and LNG) to Europe declined by 8.1% month on month to 4.52bcm in February amid flagging demand for Russian LNG, industry data showed on Monday.

Russia exported an estimated 2.55bcm of gas via two remaining pipeline routes to Europe, a monthly decline of 0.11bcm, or 4.1%, according to European gas TSO group Entsog.

LNG shipments from Russia to Europe – excluding Turkey – were down 12.8% to 1.97bcm, showed ship-tracking data from consultancy Kpler.

Of the total, Belgium was the largest importer, with deliveries accounting for nearly half of all Russian supply, or 0.95bcm.

France was the second-largest importer, with shipments making up 30% of the February total, or 0.6bcm.

Although Europe imposed bans on Russian oil and coal imports in the wake of the country’s invasion of Ukraine in February 2022, it continues to allow gas into the region, albeit with the aim of phasing out all such imports by 2027.

Prior to the war, the region sourced some 40% of its gas from Russia, but this has dropped to less than 10% amid increased supply from other origins, reduced overall demand and increased renewables capacity.

Pricier LNG

Yuriy Onyshkiv, a Kyiv-based gas market analyst at LSEG, said while the lower pipeline volume could in part be attributed to February being a shorter month, the drop in LNG exports was “much bigger”.

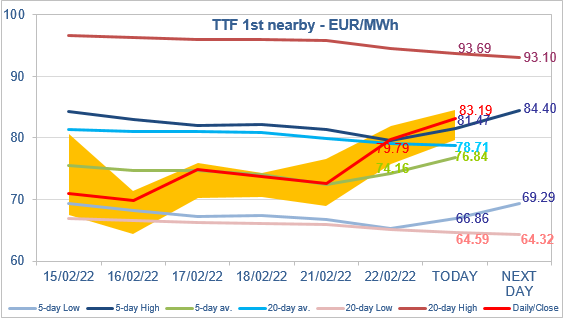

“This can be explained by the fact that Russian gas, which is normally pegged to TTF front-month contract was more expensive in February than other origin gas traded on spot or day-ahead market,” he noted.

Indeed, the benchmark TTF front-month contract averaged EUR 26/MWh last month on exchange Ice Endex, compared with average day-ahead prices of EUR 25/MWh via brokers.

Also, Jack Sharples, senior research fellow at the Oxford Institute for Energy Studies, pointed out that Russia is allocating more LNG supply to Asia to meet contractual obligations, despite some disruptions in the Red Sea caused by attacks on international shipping by Iran-backed Houthi rebels.

“There has been an impact on Russian LNG exports to Asia via the Suez Canal, that are now being diverted via the Cape of Good Hope,” he said, noting some of the “flexible” volumes that would otherwise have been sold on the European spot market were being used to meet contractual commitments to Asia.

“The current dynamics suggest that Russian pipeline flows to the EU will remain stable for the rest of 2024,” Sharples said.

“However, the expiry of the contract for transit via Ukraine on 31 December does create uncertainty about the future of Russian pipeline gas deliveries to Slovakia and Austria,” he said, regarding the conclusion of a five-year contract with Gazprom, which saw around 15bcm of gas delivered to the EU last year.

Source: Laurence WALKER (Montel)