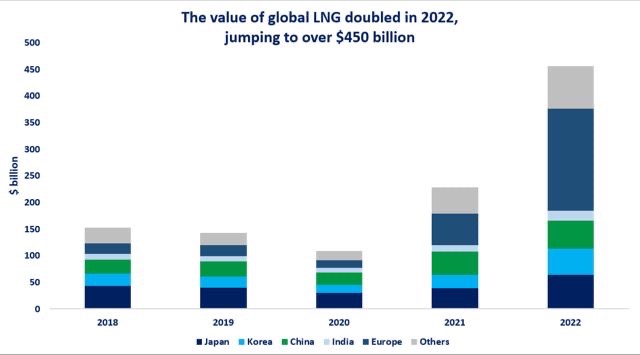

The value of global LNG doubled in 2022, to a staggering $450 billion amidst the record high gas prices in Asia and Europe.

The LNG import bill of the key Asian markets rose rather moderately, by just over 50% compared to 2021.

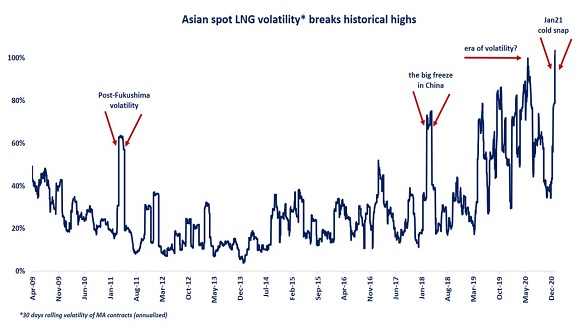

The higher share of oil-indexed, long-term contracts alleviated some of the prevailing market volatility and reduced the impact of record high spot prices on actual import costs.

China’s LNG import bill is expected to increase by just 20%, as the country slashed its LNG imports by over 20% and reduced drastically its exposure to spot LNG.

In contrast, Europe’s LNG import bill more than tripled, with LNG inflow rising by 60% and import prices more than doubling.

While the flexibility of spot LNG has been instrumental to offset Russia’s gas supply cuts, it comes at a significant premium compared to long-term contract LNG supply, putting further pressure on European import bills and economies.

The value of global LNG rose by around $230 billion in just one year, translating into unprecedented windfall profits for oil&gas companies.

It is also an historic opportunity to use additional cashflow to boost investment into clean energy fuels and reduce the emission intensity of existing gas & LNG value chains.

What is your view? How will the value of LNG evolve in 2023?

Should Europe reduce its exposure to spot LNG? How will be the windfall profits used by the major portfolio players?

Source: Greg MOLNAR