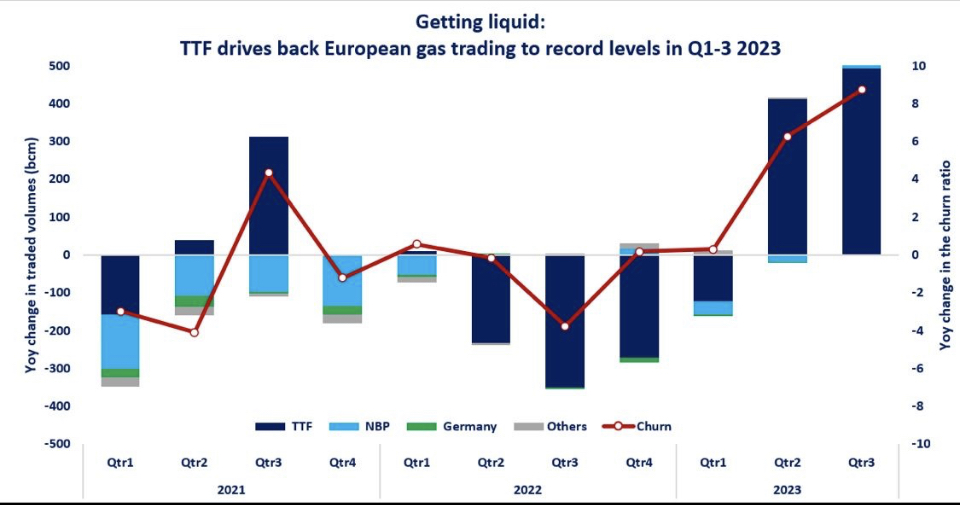

Following the steep drops recorded in 2022, TTF drives the recovery in European gas trading to new record highs, with traded volumes surging by 30% yoy in Q1-3 2023 on the Dutch gas hub.

Last year’s record high gas prices drove up significantly margin requirements, increasingly rapidly the costs related to holding positions, especially for market players with more limited financial capabilities.

This in turn led to a sharp declined in traded volumes (-15% yoy) and ultimately weighed on the liquidity of the European market. TTF born the brunt of the decline, with its traded volumes plummeting by close to 20%.

Lower gas prices in 2023, together with the need to hedge positions in an increasingly uncertain market environment led to rapid recovery in European gas trading: overall traded volumes rose by 17% yoy in Q1-3 2023, with the recovery almost entirely led by TTF where traded volumes rose by 30% yoy.

In terms of liquidity, the churn ratio for EU+UK rose from 13 in 2022 to over 18 in Q1-3 2023.

This strong recovery shows the resilience of Europe’s traded gas market following the 2022 gas supply shock triggered by Russia. it also highlights the growing role of TTF, which now accounts for around 80% of EU gas trade and is increasingly used as a hedging venue by global portfolio players and trading houses.

What is your view? How will gas trading evolve in the coming winter months? Will we see TTF gain more volumes from NBP in the coming years?