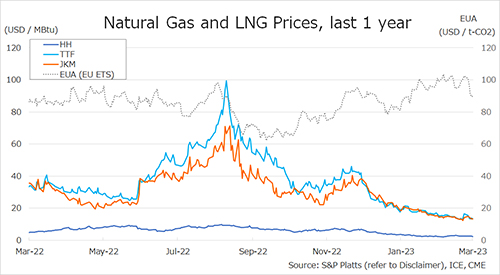

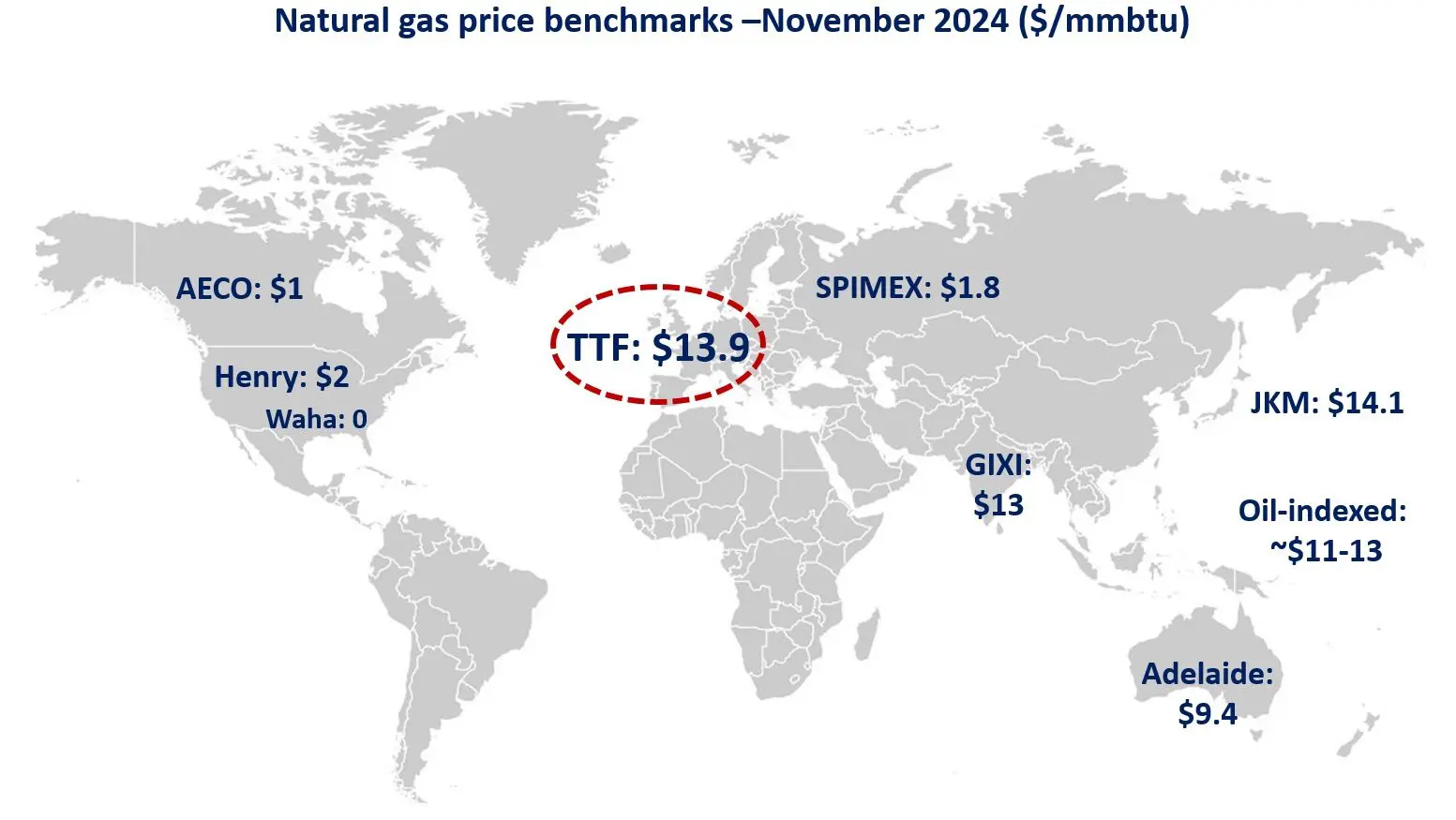

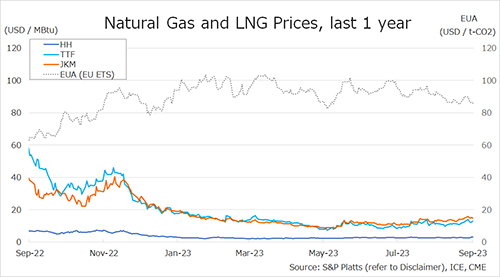

The Northeast Asian assessed spot LNG price JKM for the previous week (25 – 29 September) rose to the high USD 15s on 25 September from the mid USD14s the previous week due to winter procurement by Japan and Korea, etc. and supply concerns from the Norwegian gas fields.

However, it fell to the mid USD 14s on 29 September amid the slowdown of activities in China, Korea and other countries due to national holidays. METI announced on 27 September that Japan’s LNG inventories for power generation totaled 1.56 million tonnes as of 24 September, down 0.03 million tonnes from the previous week.

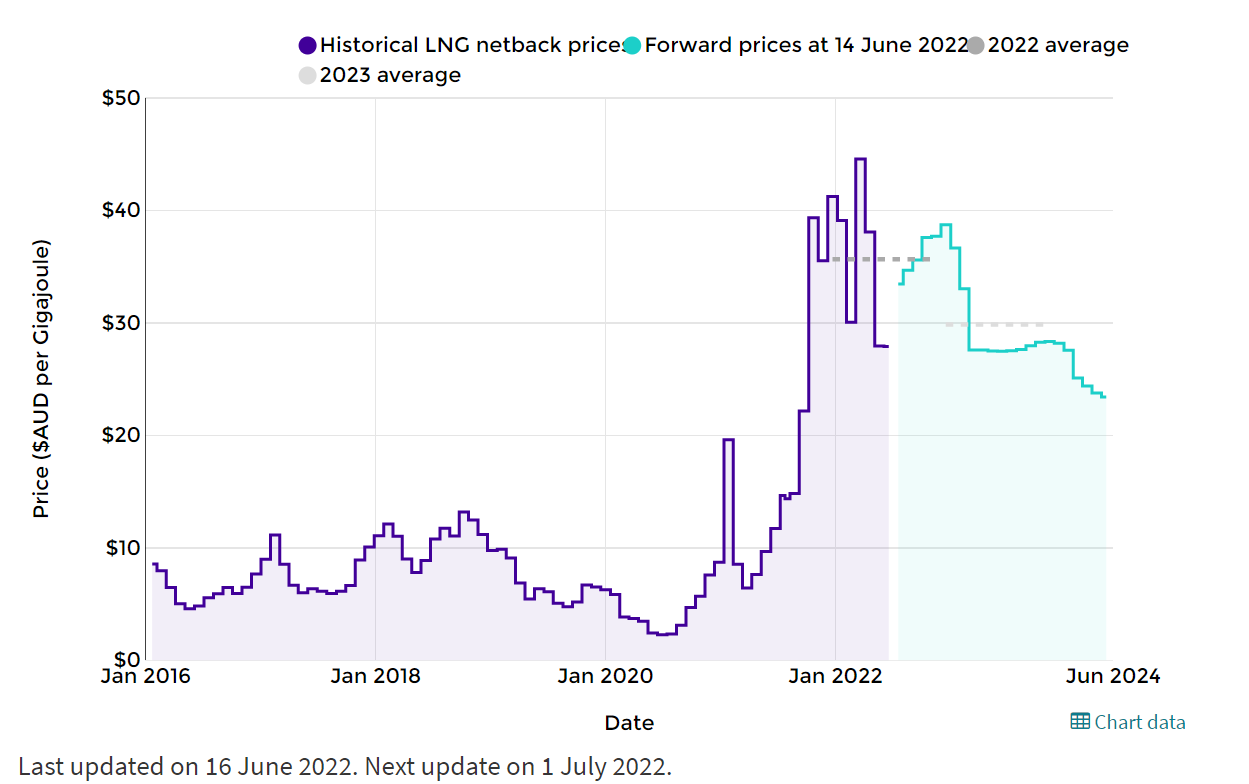

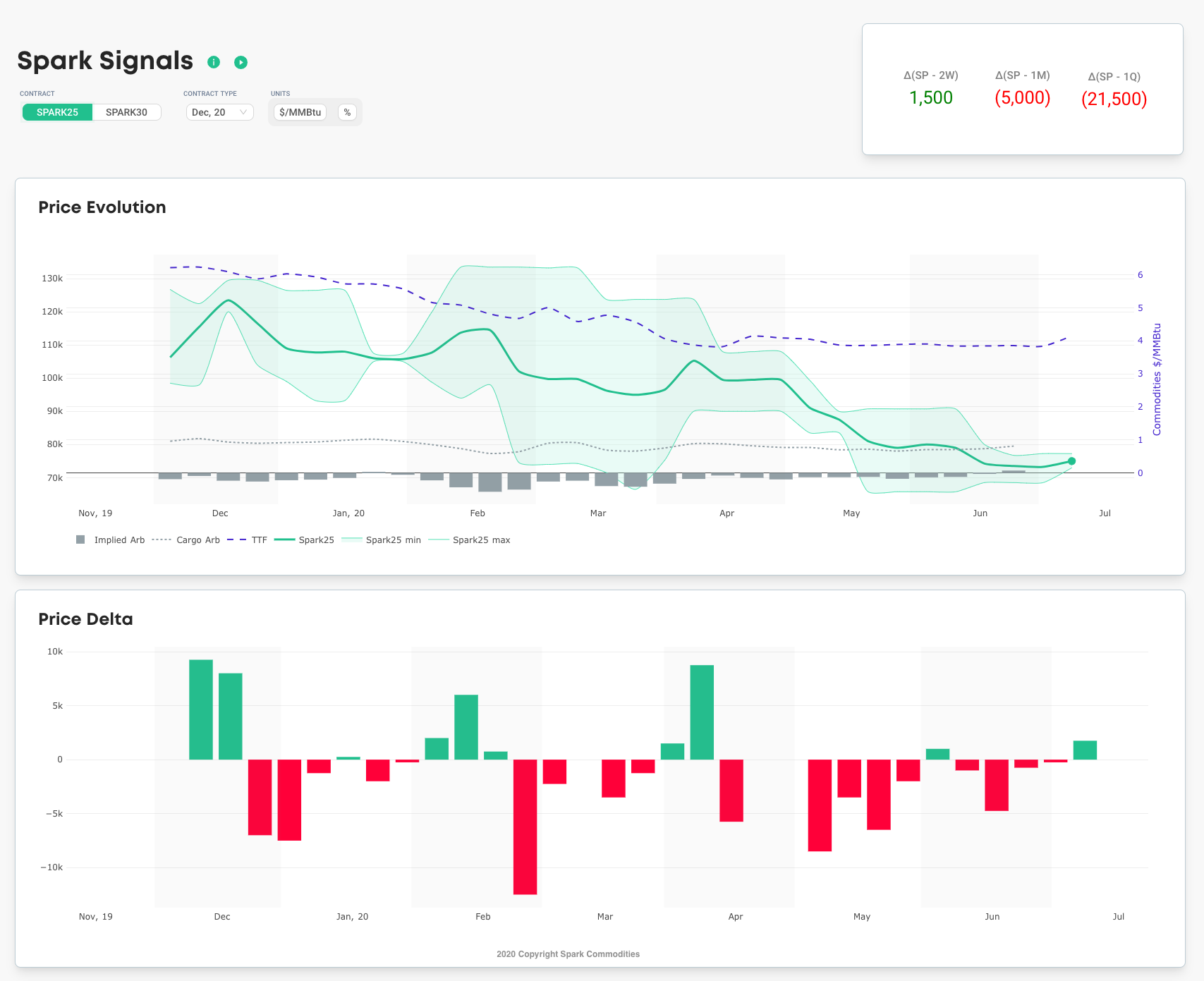

The European gas price TTF rose to USD 13.8/MBtu on 25 September from USD 12.4/MBtu the previous week on the back of reduced supply from the Norwegian gas fields, but fell to USD 12.2/MBtu the next day due to weak demand and abundant inventories.

The TTF front-month futures moved over to November trading on 29 September, with a downward trend for the coming winter months. ACER published the 29 September spot LNG assessment price for delivery to the EU at EUR 40.7/MWh (equivalent to USD 12.6/MBtu). According to AGSI+, the European underground gas storage rate as of 29 September was 95.4%, up from 94.5% the previous week.

The U.S. gas price HH rose toward the end of the month from USD 2.6/MBtu the previous week to USD 2.9/MBtu on 28 September, but was almost unchanged from the previous day on 29 September on expectations of lower demand for the fall season.

According to the EIA Weekly Natural Gas Storage Report released on 28 September, the U.S. natural gas underground storage on 22 September was 3,359 Bcf, up 90 Bcf from the previous week, up 13.4% from the same period last year, and up 6.0% from the average of the past five years.

Updated: October 2

Source: JOGMEC