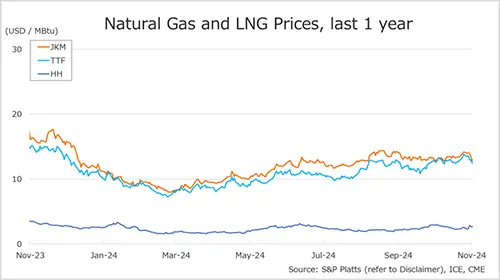

The Northeast Asian assessed spot LNG price JKM (December delivery) for last week (28 October – 1 November) fell to high-USD 12s on 1 November from low-USD 14s the previous weekend (25 October).

In the first half of the week, the price moved modestly around USD 14 amid no significant change in fundamentals, but on 1 November fell by more than one dollar to a three-week low, following a significant fall in European gas prices.

METI announced on 30 October that Japan’s LNG inventories for power generation as of 27 October stood at 2.07 million tonnes, down 0.10 million tonnes from the previous week, the first decline in five weeks.

The European gas price TTF for last week (28 October – 1 November) fell to USD 12.5/MBtu (December delivery) on 1 November from USD 13.8/MBtu (November delivery) the previous weekend (25 October).

The delivery month changed to December on 31 October. TTF was on a downtrend due to stable supplies from the Norwegian continental shelf, mild weather and the Middle East situation, with Israel not targeting Iran’s oil and nuclear facilities and supply concerns receding.

Then it fell even more sharply on 31 October following reports of potential Azerbaijani gas supply to Europe via Ukraine. According to AGSI+, the EU-wide underground gas storage was 95.2% on 1 November, almost unchanged from 95.2% at the end of the previous weekend.

The U.S. gas price HH for last week (28 October – 1 November) rose to USD 2.7/MBtu (December delivery) on 1 November from USD 2.6/MBtu (November delivery) the previous weekend (25 October). The delivery month changed to December on 29 October.

The EIA Weekly Natural Gas Storage Report released on 31 October showed U.S. natural gas inventories as of 25 October at 3,863 Bcf, up 78 Bcf from the previous week, up 2.8% from the same period last year, and 4.8% increase over the five-year average.

Updated: November 5

Source: JOGMEC