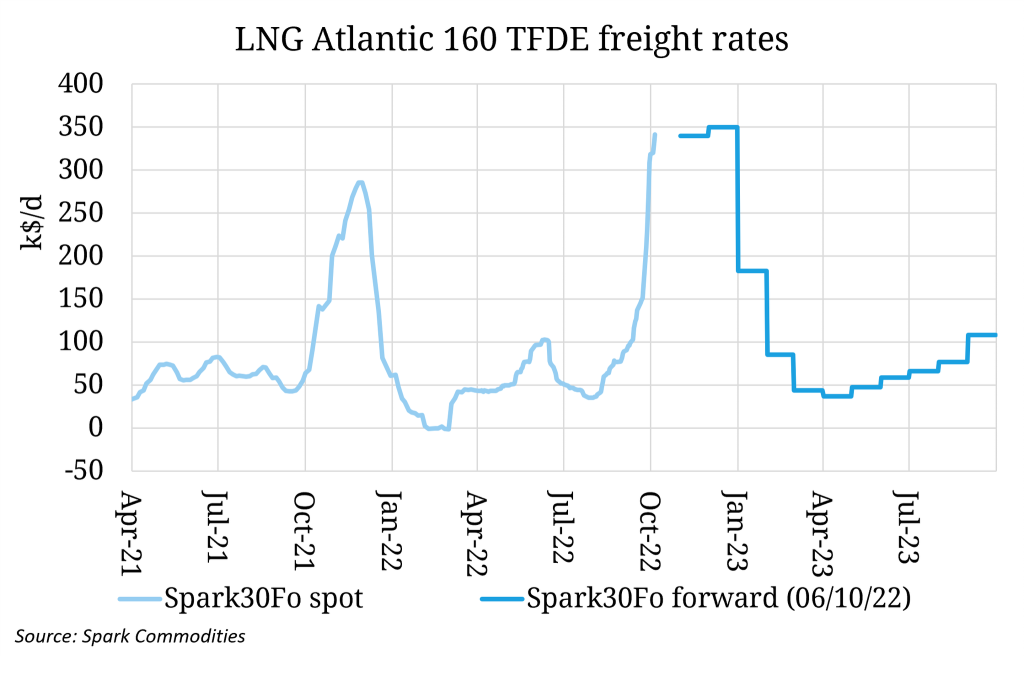

Europe’s pivot away from Russian gas and towards LNG has driven a reorientation of trade flows reducing tonne-miles, as flexible Atlantic Basin cargoes increasingly remain within basin.

While this contributed to the collapse in charter rates in early 2022, the Spark Atlantic spot freight assessment (30S, 160 TFDE) has reached a record high of 341 k$/day, after climbing sharply through September.

Larger vessels have been heard to fix higher still, with reports of a charter above 400 k$/d.

The recent rally has been driven by a combination of:

– Congestion in accessing premium European terminals and a contango in the DES NW Europe and JKM forward curve leading to a build of volume floating on the water

– Limited availability for spot charter as strongly positive netbacks and high volatility incentivises market participants to charter in aggressively to retain optimisation flexibility in their portfolio

– Seasonally stronger loadings into winter driving higher tonnage of LNG on the water.

Spark forward assessments show rates marked near record highs over the remainder of 2022, reducing below 100 k$/d by February.

Source: Timera Energy