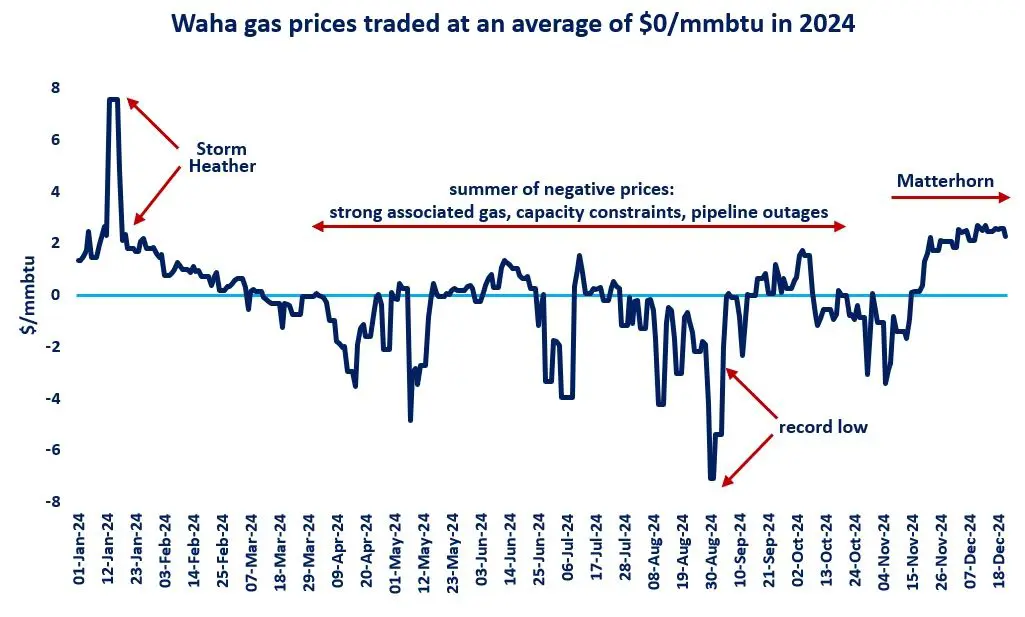

The cheapest gas on earth: Waha gas prices in the Permian traded at an average of $0/mmbtu in 2024 – the lowest annual average for any gas hub on record. But how did we get there? And what is driving this?

The shale gas revolution unleashed an unprecedented growth in tight oil and associated gas production in the Permian, with the latter growing by more than eightfold in the last ten years.

The surge in associated gas production means that gas output has been growing more quickly than takeaway capacity, both in terms of processing plants and pipelines.

As a consequence, infrastructure became saturated in recent years, driving down gas prices often to negative territory, effectively meaning that producers had to pay for someone taking there gas… so that they can continue to produce something more valuable: crude oil.

But 2024 was extreme even per Waha standards: the hub spent 164 days in negative territory through the year and hit an all-time low -$7/mmbtu at the end of August, ahead of the Labour Day weekend.

There are several factors behind this:

(1) associated gas production continued to boom, with output surging by more than 10% despite muted demand;

(2) full storage: gas storage sites in Texas were already 70% full at the beginning of April, meaning that there was limited injection demand through the summer;

(3) pipeline maintenance through the summer further limited takeaway capacity, including via the El Paso pipeline system;

(4) pipeline delays: the Matterhorn pipeline was delayed several times, including after Hurricane Beryl, which further depressed gas prices at Waha.

The gradual ramp-up of the Matterhorn pipeline (25 bcm/y) since October is providing some relief to Waha prices, which now moved to positive territory, although an unplanned outage at a major pipeline could easily push back them again to negative territory.

There are several new pipeline projects under development, including the Hugh Brinson Pipeline (15 bcm/y) which just received FID and is expected to start operations by the end of 2026.

The unbelievably cheap Permian gas is perfect match to serve the AI revolution which is underway and feed energy hungry data centers, which will be the key customers the Brinson Pipeline.

What is your view? How will Permian gas production evolve in the coming years? Could we see more negative prices in Waha? will the Permian feed the AI revolution

Source: Greg Molnar