Global gas prices strengthened across Asia and Europe last week as colder weather forecasts and heightened geopolitical risks supported near-term demand, while US prices remained comparatively soft despite increased volatility.

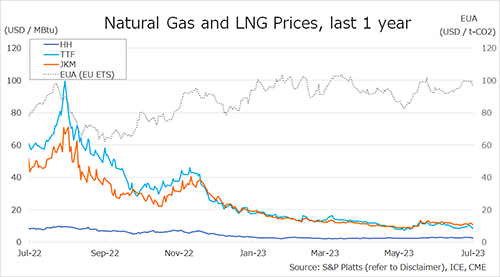

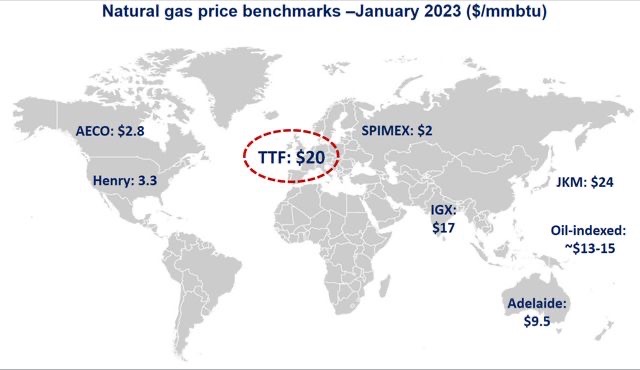

The Northeast Asian spot LNG benchmark JKM (March delivery) rose to the low-USD 10s/MMBtu by mid-January, recovering from earlier weakness as colder temperature forecasts boosted short-term buying interest. Prices were also supported by rising European gas benchmarks, encouraging some rebalancing of Atlantic Basin cargo flows toward Asia. Despite the uptick, overall spot demand remained measured, with buyers continuing to rely on adequate inventories and flexible supply availability.

European gas prices firmed, with TTF (February delivery) climbing above USD 11/MMBtu during the week as colder weather increased heating demand and storage withdrawals accelerated. Market sentiment was further supported by geopolitical uncertainty, particularly in the Middle East, which added a risk premium despite broadly comfortable LNG supply conditions. EU gas storage levels continued to trend lower, reinforcing sensitivity to short-term weather shifts.

US Henry Hub prices remained relatively subdued, trading around USD 3–4/MMBtu, as ample domestic supply and high storage levels capped gains. While colder weather forecasts provided intermittent support, the market remained weighed down by strong production and limited immediate upside in LNG export economics.

Source: JOGMEC