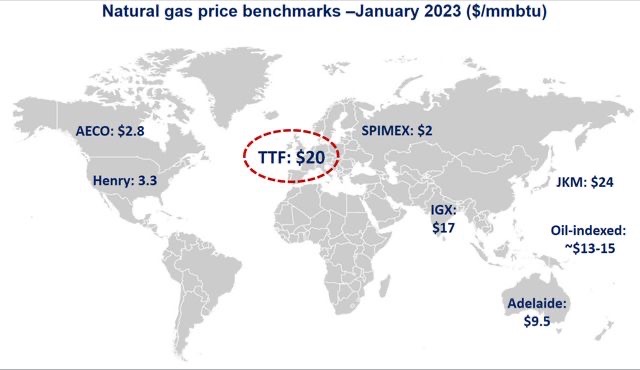

Natural gas prices tumbled by over 40% across key gas markets in January, amidst unseasonably mild weather.

In Europe, TTF month-ahead prices dropped by 44% to an average of $20/mmbtu. This is about one-third lower than last year’s Jan prices, but still almost 4 times higher than historic TTF prices.

Unseasonably mild weather, together with strong winds pushed down gas demand by over 20% yoy, while industrial gas use remains depressed amidst the limited upside flexibility of certain industrial sectors. EU storage levels are now standing almost 40% (or 20 bcm) above their 5y average.

In Asia, JKM prices followed suite, although dropping less steeply, by 25% to $24/mmbtu.

This marks the return to Asian premium, which if maintained could reduce the LNG inflow into Europe in the coming months. China’s demand will be a key determining factor here.

In the US, Mr Henry dropped by 40% to $3.3/mmbtu -its lowest monthly average since Jun21. unseasonably mild weather was severely weighing on residential and commercial demand, while the continued delay of Freeport reduced the expected LNG feedgas flows.

Lower Henry dragged down its Canadian buddy, AECO, which dropped by 40% on lower piped gas deliveries to the US.

What is your view? How will gas prices evolve through the remainder of the heating season? Do you see any upside potential?

Source: Greg MOLNAR (LinkedIn)