(Rajat Kapoor) Petronet LNG Limited has adopted the Platts West India Marker (WIM) for an upcoming tender to purchase an LNG spot cargo in November.

This is the first time an Indian purchaser has executed a cargo acquisition priced at the Platts WIM benchmark.

This decision by Petronet LNG to adopt the WIM to buy LNG spot cargos shows growing interest from Asian buyers to shift to pricing that is more reflective of market conditions and move away from erstwhile crude oil linked deals.

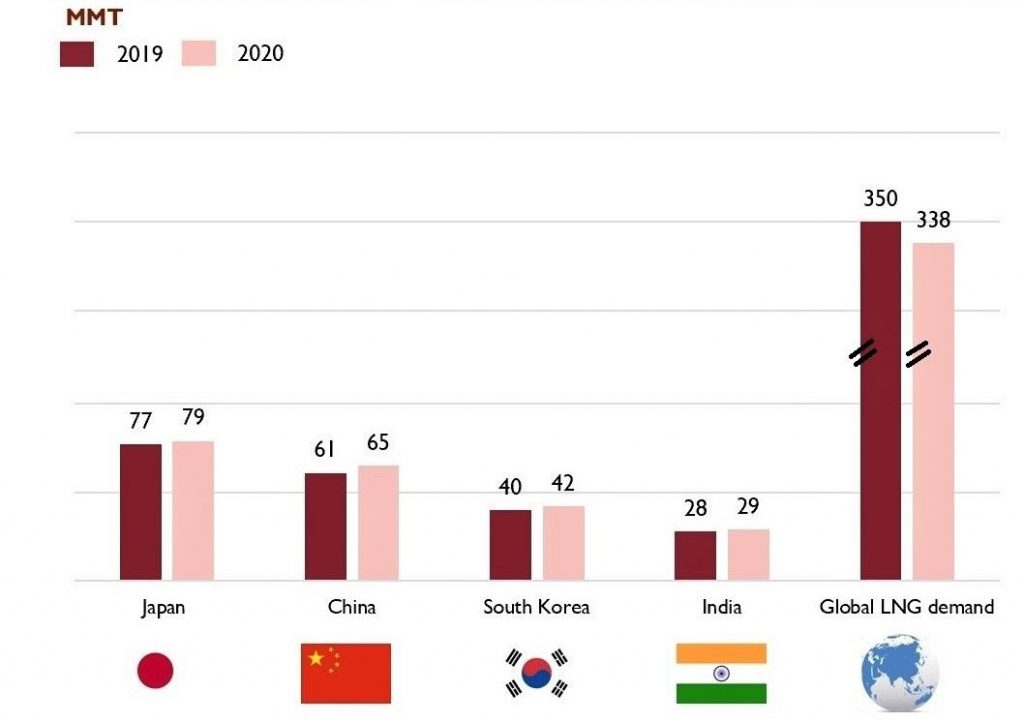

India is one of the fastest growing LNG importers and is expected to be one of the few countries that will see an increase in LNG imports this year, over 2019, in spite of the Covid induced slowdowns (see graph).

The overall global demand for LNG in 2020 is expected to see a drop over 2019 primarily on account of slowing down of major economies due to restrictions and quarantine measures.

The Asian economies are likely to be the only countries that would end 2020 with a net growth in LNG imports, over least year China, the worlds second largest LNG importer will record the highest growth in demand this year as the country open its economy after having been largely successful in tackling the Covid crisis

See original post by Rajat on LinkedIn