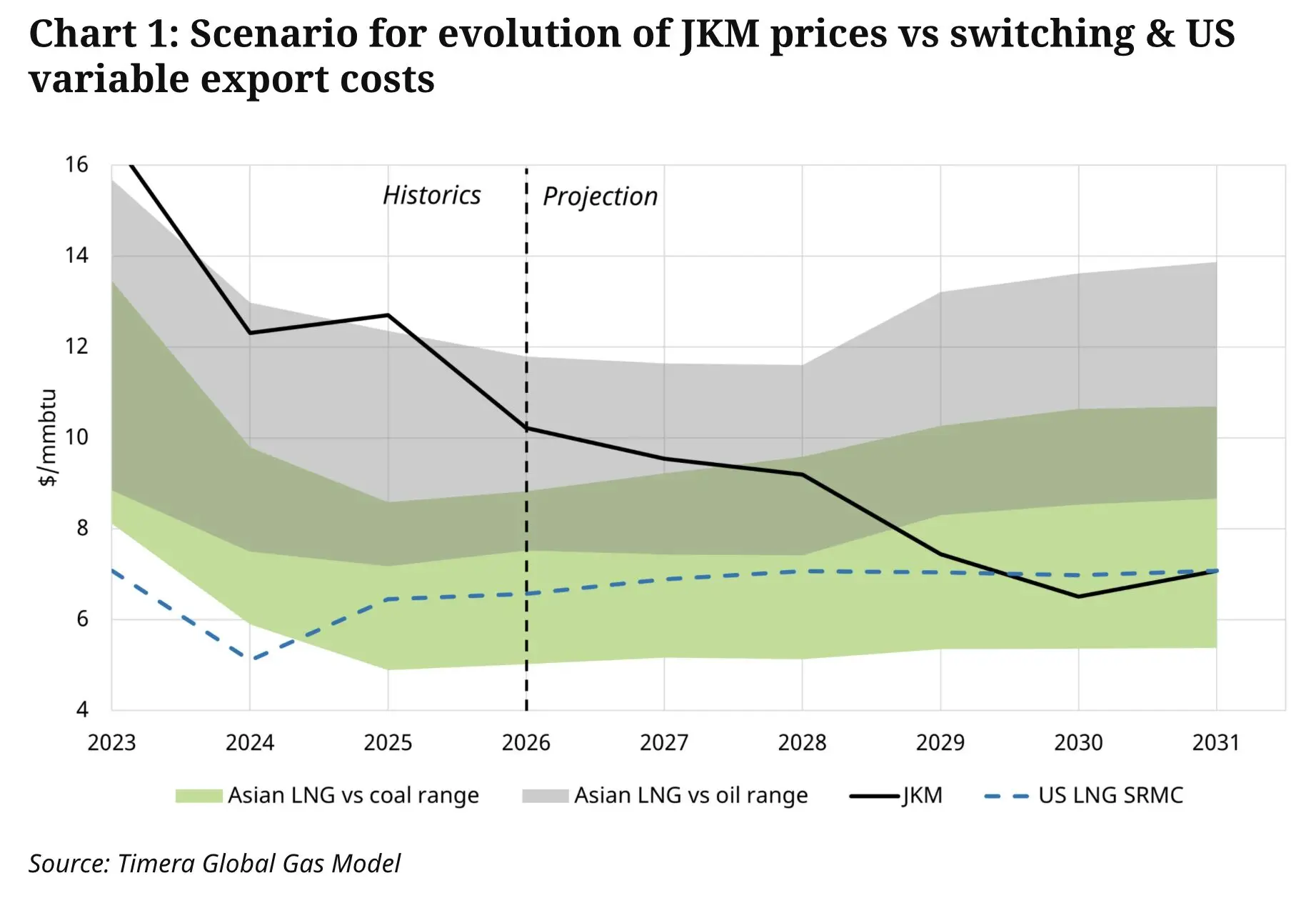

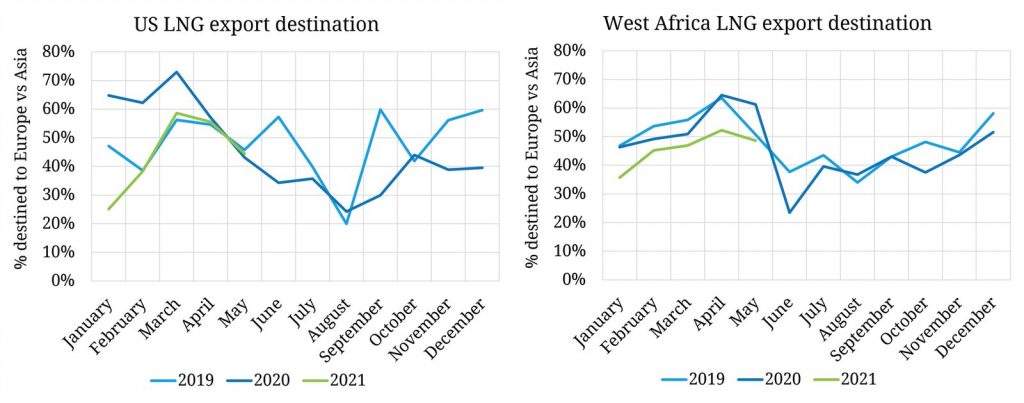

(Source: Timera Energy) Earlier this year we introduced Asia’s share of combined Asian and European LNG import volumes as a barometer of LNG market tightness. Today we look in more detail at two of the marginal sources of swing supply between Asia and Europe, and the % of exports directed at the latter.

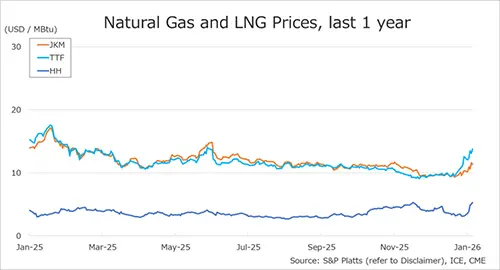

A higher percentage share of exports to Europe as compared to Asia generally indicates a looser market (with the exception of Q3 2020, which was skewed by US cargo cancellations), while a lower percentage to Europe indicates a tighter market. This can be seen clearly in January 2021, where extreme cold saw JKM prices spike in an effort to pull marginal cargoes away from the Atlantic. Similarly, a structurally lower proportion of both US and West African cargos are heading towards Europe across 2021 compared to 2020, as the market tightens.

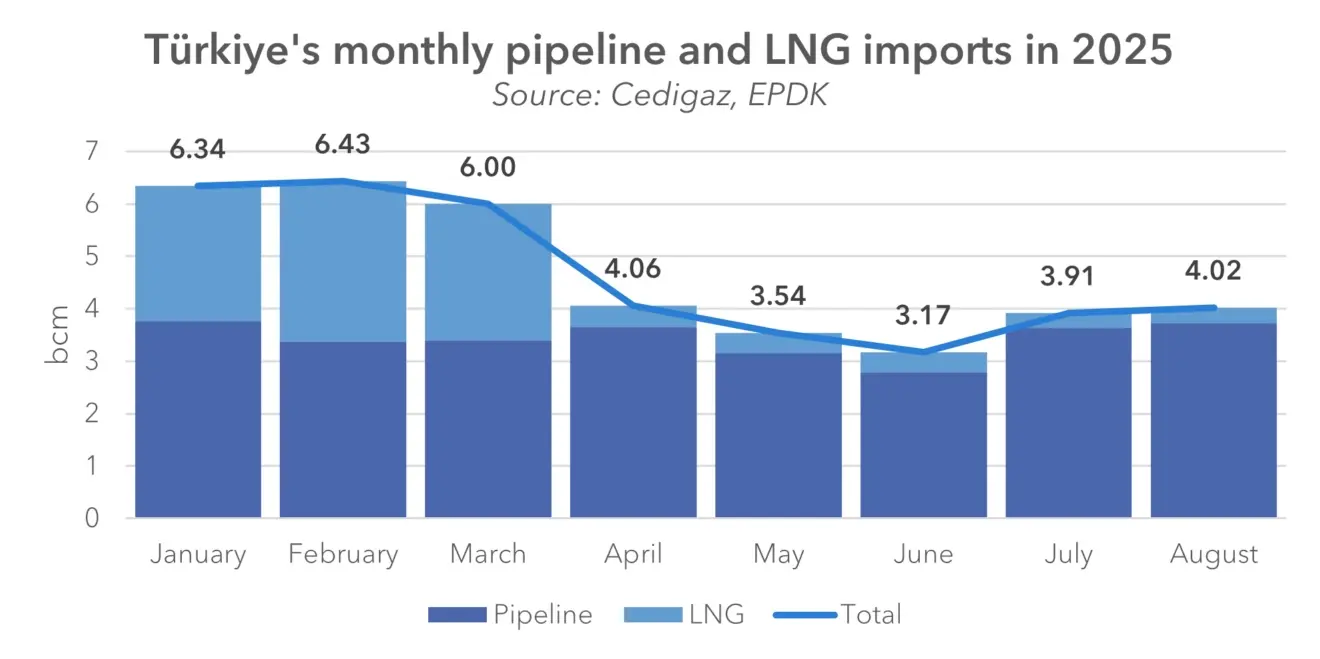

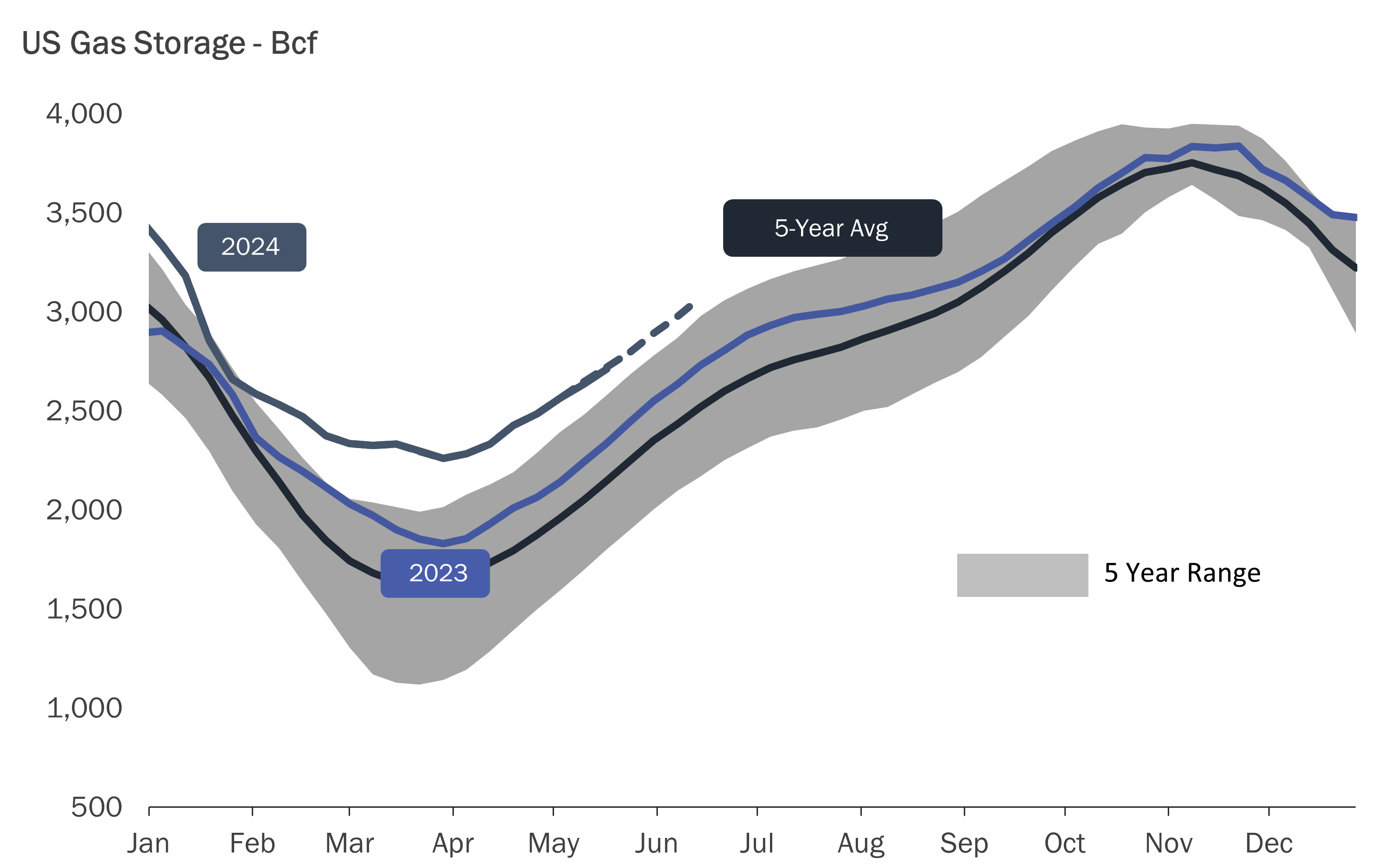

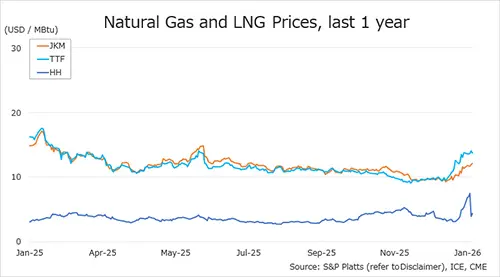

Asia is becoming increasingly dominant as we head into Q3 (driven by strong power demand across NE Asia), with the June share of imports into Europe expected to jump lower. As Europe struggles to refill its storages, Asia and Europe will increasingly battle for molecules from these swing suppliers, with forward expectations played out in the relative JKM and TTF market prices.

Source: Timera Energy