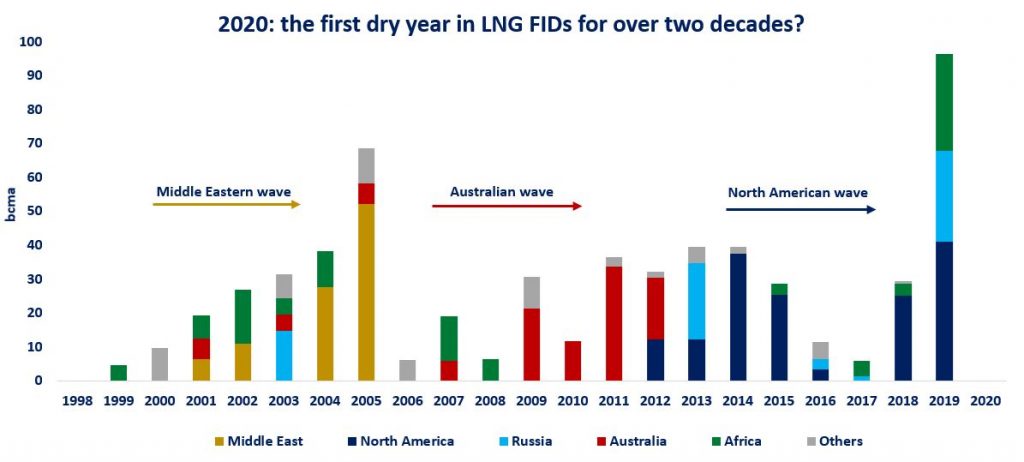

2020 is likely to become the first dry year in LNG investments for over two decades, with not a single project daring to take FID in the current market context.

After a record year in 2019, when almost 100 bcm/year liquefaction capacity reached FID, with investments tallying up to over $50/billion, this year we saw 200 bcm of liquefaction FIDs being cancelled or postponed.

And while LNG is often in the spotlight, it is important to highlight that entire oil & gas value chain is suffering from an unprecedented (-34% yoy) drop in investments, including exploration and upstream development. this in turn, if investments don’t pick up, could put additional stress on gas supply chains, diminish delivery efficiencies and lead to new price cycles.

What is your view? Who will be leading the next wave of FIDs? After the Australian and North American wave is it time for the Middle East, led by Qatar to make a come back?

Source: Greg Molnar

See original post by Greg on LinkedIn.