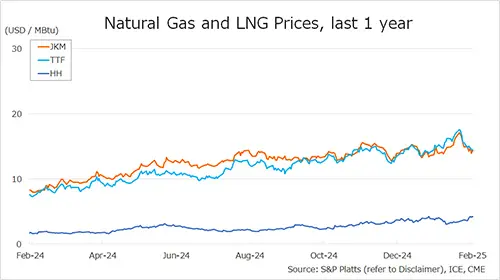

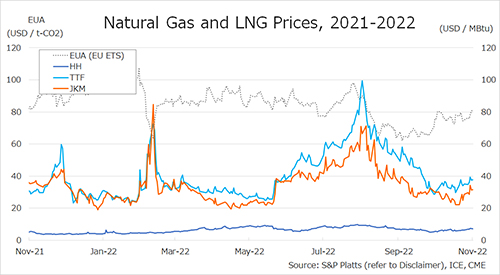

Normally, it is Asian players that dominate the LNG market and determine price direction globally. But since late 2021 a different pattern has been observed, with Asian spot cargo prices tracking the movements at the European gas hubs.

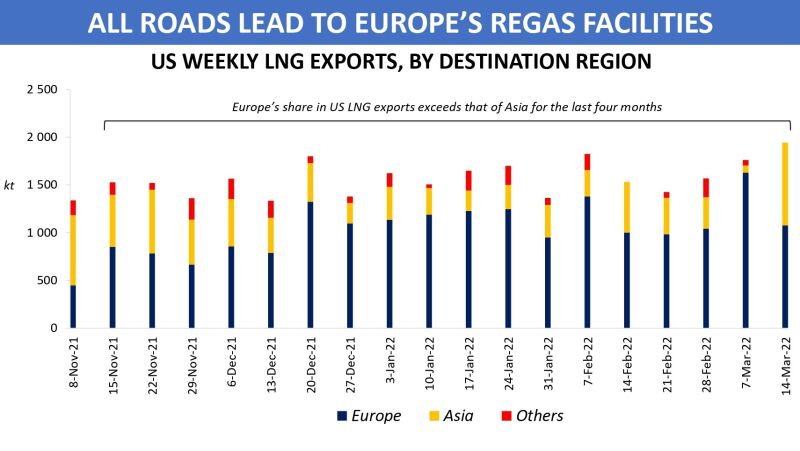

Of all major LNG producers, the US provides the largest number of flexible cargoes to the global market, and Europe made up the highest proportion of its weekly exports for the past four months. For the first time since the period between November 2019 and March 2020, Europe’s share in the US LNG exports exceeded that of Asia for so long.

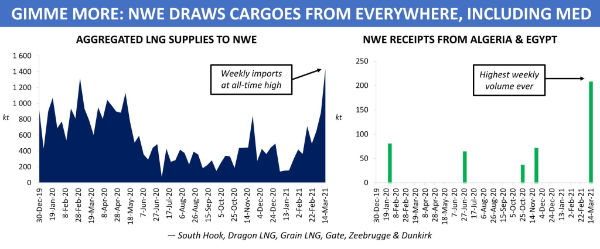

With gas storage inventories standing at low levels and pipeline supply being tight, European buyers have actually had no choice but to rely on spot LNG. And geopolitics lifted TTF contracts to fresh record highs, thus leaving little chance for other regions to compete successfully for available volumes. Last week, more than 20 US-loaded LNG vessels were signalling arrivals at European regas facilities while only one cargo was sent towards Asia, according to Kpler data.

As there have been a strong demand for additional LNG imports from Europe in recent months, Asian importers remained relatively inactive in seeking spot cargoes.

Amid above-average LNG stocks accumulated in Northeast Asia in the run up to this winter season, which has so far been much warmer than expected, average monthly exports of LNG from the US to China, Japan, South Korea and Taiwan combined were about 40pc lower YoY between November 2021 and mid-March 2022.

Risk premium added to the European market has declined noticeably since early March, making spot LNG deliveries to Asia more profitable. The high-price environment may continue to somehow constrain the region’s demand for spot cargoes, especially among buyers in South Asia, but importers in Northeast Asia will find it much harder to stay away as terminal tanks need to be replenished ahead of the summer peak demand.

The question is whether Asian buyers’ appetite for spot LNG will be strong enough to draw a significant number of cargoes away from Europe in the shoulder period.

Source: Yakov Grabar (LinkedIn)