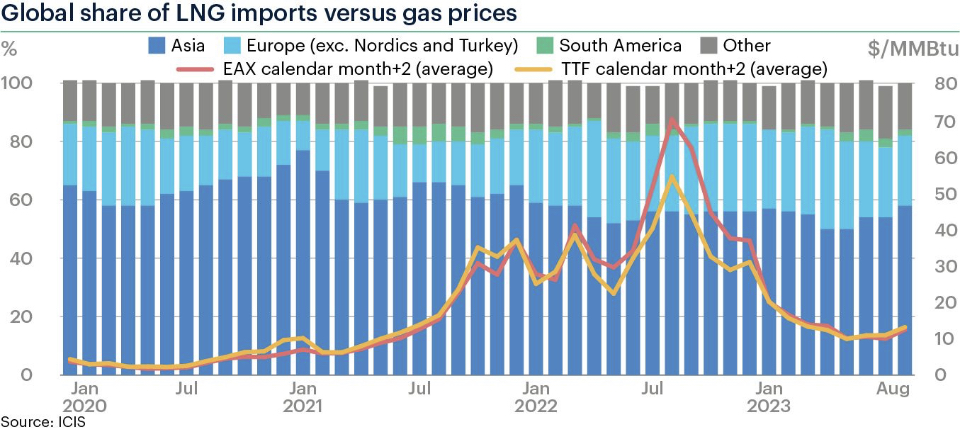

Asia

LNG imports for the top 5 buyers – China, Japan, South Korea, India and Taiwan – climbed to ????????.???????? tonnes in August, a month-on-month increase of 13% according to updated ICIS data.

The 2020-2022 average for the month is 18.6m tonnes.

The region’s share of global LNG imports hit 58%, 4 percentage points higher than July’s inflows according to the revised figures.

China continues to be the leading Asian importer, a position it has held since March, with the country taking in 6.4m tonnes. This was a monthly uptick of 3% and a yearly jump of 36% jump.

Europe:

Imports totalled 8.1m metric tonnes in August, an 1% increase month on month according to revised data from ICIS. This also marks the first monthly gain since April.

The 2020-2022 average for the month is 5.8m tonnes.

Spain was the regional leader with 1.6m tonnes, followed by the Netherlands (1.6m) and France (1.4m)

Europe’s share of global LNG imports was slightly below 24%, translating to a 6-month low.

South America:

South American imports – represented by Argentina, Brazil, Chile, and Colombia – were 0.6m tonnes.

Global share was ????%, down 1 percentage point month on month.

Prices:

Average ICIS TTF rolling month+2 values were $0.69/MMBtu below the ICIS East Asia Index (EAX) equivalent in August, completing three consecutive months of discounts. This is the longest sequence since November 2021 although the discount was smaller than July’s $1/MMBtu.

European hub prices were trading at a discount with regional supply margins bolstered by the EU gas storage surpassing its 90% fullness target 3 months early, while demand has outturned 9-19% below the 5-year average across the summer. This has enabled an uptick in Asian buying activity with global competition easing and LNG prices softening.

Nonetheless, European prices have been more volatile in recent weeks amid changes to the Norwegian gas infrastructure maintenance schedule while potential industrial action at Australian LNG export facilities has emerged as a supply risk.

Source: Christopher RENE (ICIS Energy)