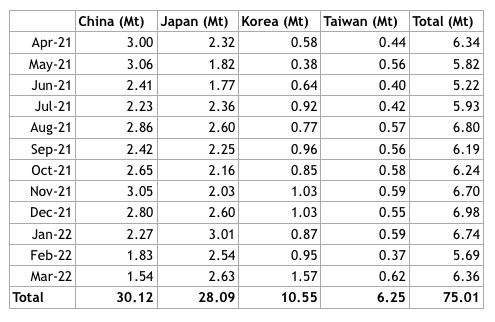

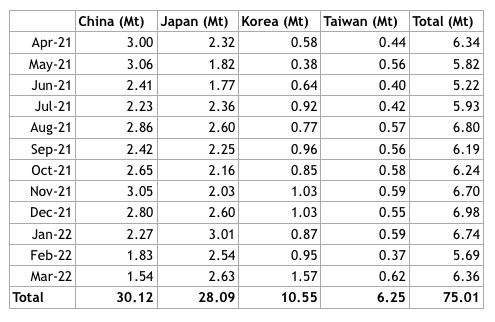

North Asian LNG imports have fallen due to high prices leading to demand destruction and the COVID slowdown in China. The most recent comprehensive data on LNG imports is for February (See chart).

This shows that LNG imports were down by 17.7% month-on-month (mom) in North Asia (Japan, China and Korea) in February. Imports by China, the powerhouse of LNG demand, were down by 12.4% mom on the back of high prices and the COVID slowdown. Volumes were also down in Japan (-11.9% mom) and Korea (-32.6% mom). In this environment Australia did well, with sales only down by 4.7% mom.

One reason is that there has also been a fall in deliveries from the US and Qatar, which have been diverting their cargoes to Europe where they can earn higher margins with currently higher gas prices and shorter distances. In February North Asian imports from the US were down 73.5% mom (with zero imports by China) and imports from Qatar were down 17.1% mom.

Notwithstanding weaker North Asian demand, Australia delivered 83 cargoes to the three North Asian countries in March, five cargoes more than in February. According to Goldman Sachs (8 April), total Chinese LNG imports reached their lowest point in two years in March at 3.8 Mt. Australia delivered four fewer cargoes to China in the month, down 15.4% from February.

However, this was more than offset by eight additional cargoes to Korea and one additional cargo delivered to Japan. As would be expected, the lower deliveries to China were from Gladstone projects, three fewer China cargoes from APLNG and two fewer from QCLNG, with one additional cargo from the North West Shelf. Australia also delivered an additional four cargoes to Taiwan and additional cargoes also to Malaysia and Singapore.

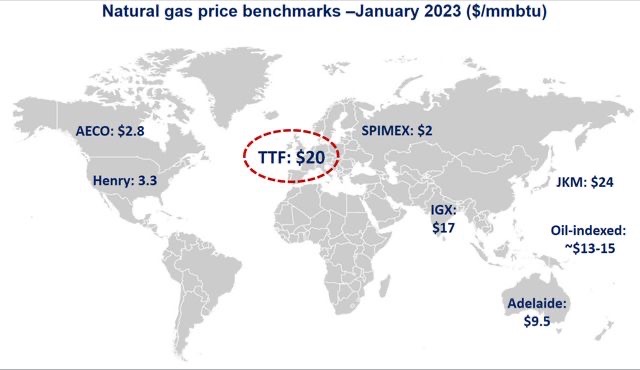

In a sign of weak Chinese demand, UNIPEC (a subsidiary of Sinopec) has sold a tender of four spot cargoes for loading during March – June from its portfolio, including from APLNG. Three of the cargoes were sold for a discount of US$2.00-5.00 on the TTF. The cargoes are headed to Europe, something rare for Australian LNG (RIM, 15 March).

While the US and Qatar have increased deliveries to Europe to replace Russian gas, Russian LNG exports have been increasing. Russian LNG exports to North Asia were up by 24.1% in February mom (albeit an increase of only 0.3 Mt), with increases to China and Korea. This is mostly prior to the invasion of Ukraine.

According to Natural Gas Intelligence (14 April), total Russian LNG exports (to Europe as well as Asia) increased by 19% mom to 3.1 Mt in March (slightly less than half Australia’s exports), mostly under long-term contracts. A fourth train at Yamal LNG came online last year, boosting Russian volumes. Japan is still accepting contract cargoes. However, some spot cargoes have been turned away for fear of further sanctions.

Russia currently produces about 8% of the world’s LNG and had announced plans to expand this to around 15% by 2030, particularly through Arctic LNG operated by Novatek (3 trains, 19.8 Mt) and Baltic LNG operated by Gazprom (2 trains, 13 Mt). However, these projects are likely to be impacted by sanctions, affecting offtake contracting, financing, access to technology and construction of LNG carriers.

Vladimir Putin has said Russia is turning its focus from Europe to Asia for gas sales and Russia should start to build the necessary energy infrastructure (Reuters, 15 April). However, even assuming willing buyers, further LNG development is constrained by sanctions and the large gas fields supplying Europe are in Western Siberia, distant from Asia.

Meanwhile, Japanese gas companies are reported to be preparing plans to source LNG from Malaysia, Australia, and the US in case of a disruption of supply from Russia (AFR, 10 April).

Most of Japan’s LNG imports from Russia come from the Sakhalin 2 project on Sakhalin Island, north of Japan. More than half of the 9.6 million Mtpa LNG Sakhalin production capacity is committed by Japanese offtakers. The project is operated by Gazprom (50% interest). Shell holds a 27.5% stake in the project but has announced that it intends to exit. Mitsui (12.5%) and Mitsubishi (10%) also hold stakes in the project (Platts, 1 March).

Australian LNG exports to Japan have been growing, even though total Japanese LNG imports have fallen. In the first three months of 2022 Australia delivered more LNG cargoes to Japan (120) than to China (80) and more to Japan than in Q1 2021 (111). In March Australia delivered 38 cargoes to Japan, up from 32 in March 2021. Japanese LNG imports have fallen (down by 12% mom in February) so Australia’s market share has increased. The market share of the US and Qatar in Japan in February was only 6% for each, half what it was in February 2021.

In February Australia’s market share in Japan was 36% based on 2.58 Mt, up from 29% a year earlier. Russia’s share was 9% (0.65 Mt). To replace Russian LNG, Japan would have to source around 8 Mtpa from elsewhere.

In the short-term the capacity of Australian projects to ship additional LNG cargoes to Japan depends on the production performance of the Australian projects. In March Australian west coast LNG projects averaged only 86% of nameplate capacity, with zero production from Prelude, Ichthys operating at 84% capacity and the North West Shelf at 90%. Prelude resuming production and Woodside supplying Pluto gas to the NWS should provide opportunities for further cargoes.

Similarly, Ichthys should be able to produce at closer to capacity. In the longer-term Scarborough and Barossa would provide further opportunities. Inpex also aspires to build a third train at Ichthys. On the east coast, QCLNG produced at 98% of capacity in March but APLNG managed only 80%, with fewer cargoes to China. APLNG would have capacity to increase shipments to Japan.

If Japan wishes to replace Russian cargoes and the US and Qatar focus on replacing Russian gas in Europe, there is certainly an opportunity for Australia to go a long way towards replacing Japan’s Russian LNG.

Source: EnergyQuest