EnergyQuest has just released its Australian LNG Monthly for September 2021. Some of the highlights are:

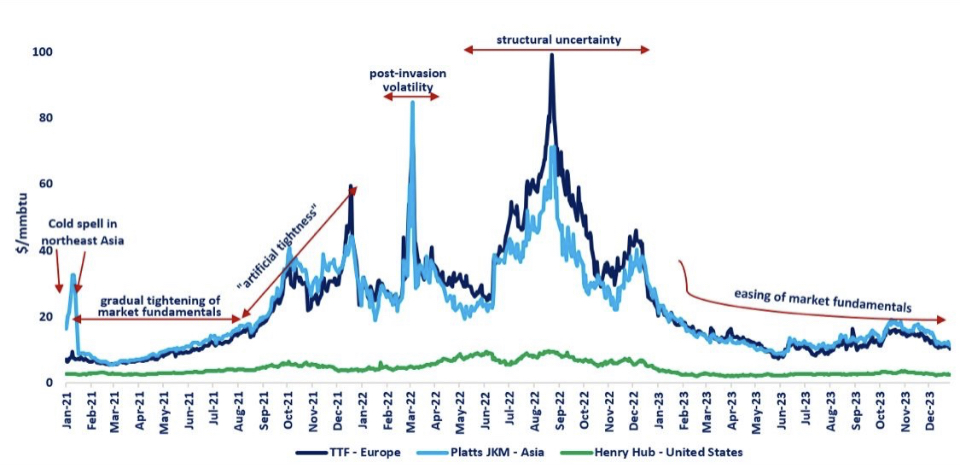

In the August LNG report we asked “What’s going on with global gas prices?”. Since then the whole energy world seems to have been asking the same question, with the cover story in last week’s issue of The Economist of “The first big energy shock of the green era”. We delve into this extraordinary development further:

Some of the other highlights of the report are:

In September Australian projects shipped 6.96 million tonnes (Mt) (101 cargoes), slightly lower than the near record 7.18 Mt (105 cargoes) in August.

Compared with August, Australian projects delivered 11 fewer cargoes to China, Japan and Taiwan in September, but seven additional cargoes to India, Korea, Malaysia and Singapore.

West Coast shipments decreased to 4.9 Mt in September (5.3 Mt in August), with 70 cargoes in September compared to 76 in August.

East coast LNG shipments increased to 2.1 Mt in September (1.9 Mt in August), with 31 cargoes compared to 29 in August.

There was one spot cargo reported from the east coast in September and five spot cargoes from the west coast (6% of total shipments).

Queensland imported gas from the other states in September.

Notwithstanding continued high LNG spot prices, Queensland short-term domestic gas prices in September were lower averaging $8.28/GJ ($8.68/GJ in August) at Wallumbilla and $8.36/GJ ($8.54/GJ) in Brisbane. Southern short-term domestic gas prices in September were also lower compared to those in August.

NEM power generation in September from coal was a record low for this time of year. Coal’s share of NEM generation was only 60%, down from 65% a year earlier. Gas generation was up by 26 GWh from a year earlier but gas-use for power generation was down slightly by 0.14 PJ in September (2%) compared with a year earlier.

Source: EnergyQuest