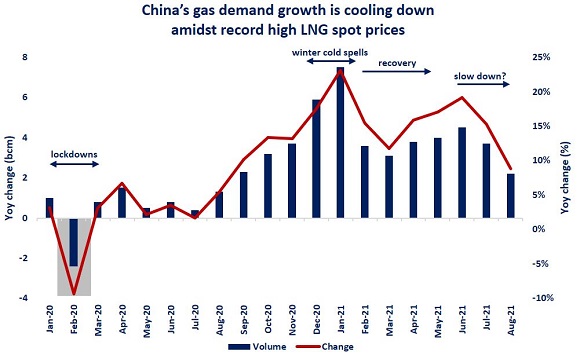

The Chinese gas dragon is cooling down: following the strong double-digit surge through the first half of the year, China’s gas demand growth started to moderate in August amidst soaring spot LNG prices in Asia.

First estimates shows that China’s gas consumption grew by 9% yoy in August, its lowest growth rate in a year -although still impressive when compared with other key gas regions.

Record high LNG spot prices are weighing primarily on energy intensive industries (such as ceramics) and on players having a greater exposure on the spot market with limited procurement alternatives.

Meanwhile China’s LNG buying spree is also cooling down, with a growth of 8% in August vs 25% through Jan-July, whilst piped gas imports from Central Asia and Russia are ramping-up, on a heavy discount (~$10/mmbtu) vs spot LNG.

Demand response to record high gas prices is also weighing on European demand, where gas burn fell by close to 5% yoy and the US, where it declined by 4% mainly due to lower gas-fired power generation.

What is your view? Will we see more pronounced demand response in the coming months? Will the demand side help to balance the current tight gas market?

Source: Greg Molnar

See original post by Greg at LinkedIn.