Global seaborne LNG trade has continued to increase last year, helped also by the events in Ukraine which forced Europe to diversify away from Russian pipeline gas, but slowed down somewhat compared to previous years.

In the full 12 months of 2023, global shipments of LNG increased by +1.7% y-o-y to 409.9 mln t, based on Refinitiv vessel tracking data.

This followed an even stronger +4.7% y-o-y increase in volumes during 2022, and a +7.3% y-o-y increase during 2021.

In Jan-Jun 2024 the positive trend continued, with volumes increasing by +1.3% y-o-y to 206.0 mln t, from 203.3 mln t in 1H 2023.

The largest exporter of LNG is now the USA, which accounted for 21.2% of shipments in 1H 2024, followed by Australia with 19.9% and Qatar with 18.8%.

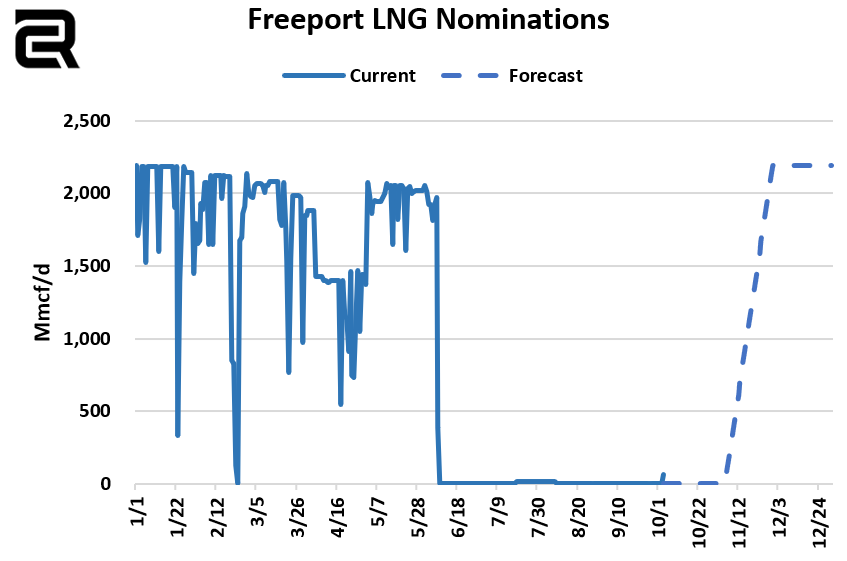

In 1H 2024, the USA exported 43.6 mln tonnes of LNG, which represented a +1.8% y-o-y increase from the 42.8 mln t shipped in 1H23.

Australia shipped 41.0 mln tonnes in Jan-Jun 2024, +0.8% y-o-y.

Qatar exported 38.7 mln tonnes in Jan-Jun 2024, -2.6% y-o-y.

Russia shipped 15.9 mln tonnes in 1H 2024, up +6.1% y-o-y from 15.0 mln t in 1H 2023, but well below the 17.0 mln t exported in 1H 2022.

The European Union remains the world’s largest importer of LNG. In 1H 2024, the EU imported 45.4 mln tonnes of LNG, down -12.2% yo-y, accounting for 22.0% of global LNG imports.

Mainland China imported 39.1 mln tonnes of LNG in 1H 2024, +17.5% yo-y from 33.3 mln t in 1H 2023.

Japan imported 33.2 mln t in 1H 2024, up +1.3% y-o-y. South Korea imported 24.2 mln t in 1H 2024, up +1.7% y-o-y. India imported 13.0 mln t in 1H 2024, up +31.7% y-o-y. The United Kingdom imported 4.2 mln t in 1H 2024, down -60.6% y-o-y.

The European Union (27) is now the largest seaborne importer of LNG in the world. Indeed, by far the biggest increase in demand over the last couple of years came from Europe.

In Jan-Dec 2022, the European Union imported 100.8 mln tonnes of LNG, an increase of +68.9% y-o-y from the 59.7 mln tonnes imported in 2021.

In terms of individual countries, this was 26.4 mln t to France, 22.8 mln t to Spain, 12.8 mln t to the Netherlands, 11.3 mln t to Belgium,

10.7 mln t to Italy, 4.5 mln t to Portugal, 4.4 mln t to Poland. In the first 9 months of 2023, the EU imported 76.5 mln tonnes of LNG, which was +4.4% more than in the same period last year.

The EU27 now accounts for 22.0% of global seaborne LNG imports, well ahead of China in second place with 18.9% and Japan with 16.1%.

In terms of sources for LNG shipments into Europe, the biggest source by far are the United States. However, volumes peaked in 2023 and are now coming down.

In the first 6 months of 2024, the EU imported 20.9 mln tonnes of LNG from the USA, down -7.4% y-o-y from 22.6 mln tonnes in 1H 2023, but still well ahead of the 8.5 mln t in 1H 2021 or the 9.4 mln t in 1H 2020.

The USA accounted for 46.0% of seaborne LNG imports into Europe in the first half of 2024. Despite all the talk of sanctions, volumes from Russia have not declined, far from it.

In Jan-Jun 2024, the EU imported 8.8 mln t of LNG from Russia, up by +14.8% y-o-y compared to 7.7 mln t in 1H 2023, and an all-time record high.

Most of the volumes (8.1 mln t in 1H 2024) arrived from Sebetta Seaport (Yamal LNG). In Jan-Jun 2023, Russia accounted for 19.4% of the EU’s LNG imports.

Qatar is now in third place amongst top suppliers to the EU, with a 10.7% share, shipping 4.8 mln tonnes to the EU in Jan-Jun 2023, -25.2% y-o-y.

Source: Bancosta Research