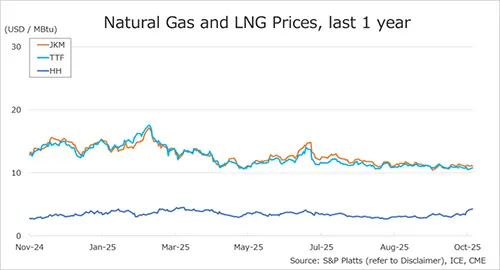

Long-term contracts were the foundations of European gas supply security, traditionally meeting more than 80% of demand. today, their share dropped to just around 50%, amidst Europe’s growing exposure to a wild and volatile spot market.

The gas and LNG industry was built on long-term contracts: while they provide exporters with financial security (and hence enable investment decisions), they ensure buyers with supply security and relative price stability (based on the mutually agreed price formula).

Since the 2022 gas crisis, the share of domestic production and LTCs in Europe’s primary gas supply dropped from over 85% in 2021 to just around 50% in the last two years. during the same period, the EU’s exposure to spot gas and flexible LNG surged from 15% to near 50%.

While the EU reduced its reliance on Russian piped gas (and contracts), this was not followed by an effective LNG contracting strategy.

In fact, European buyers accounted for less than 15% of total LNG contracts signed in 2024. and considering the expiry of existing contracts, the EU’s spot exposure could increase to two-third of total supplies by 2030.

There might be several reasons why European buyers shy away from LTCs: (1) uncertainty around European demand; (2) fear of Russian gas coming back (and squeezing profit margins); (3) methane regulations add a further layer of complexity.

However, in a world of volatility, there is a need to strike a fine balance between long-term contracts and spot procurements.

Strengthening the transatlantic LNG partnership, including through long-term contracts, could bring benefits to both shores of the Atlantic, while also moderate Europe’s exposure to spot price volatility.

What is your view? what is next for LNG contracting? is it time for Europe for a long-term commitment? (after spending too much time in expensive one-night stands?) what are the key reasons behind Europe’s commitment issue?

Source: Greg MOLNAR