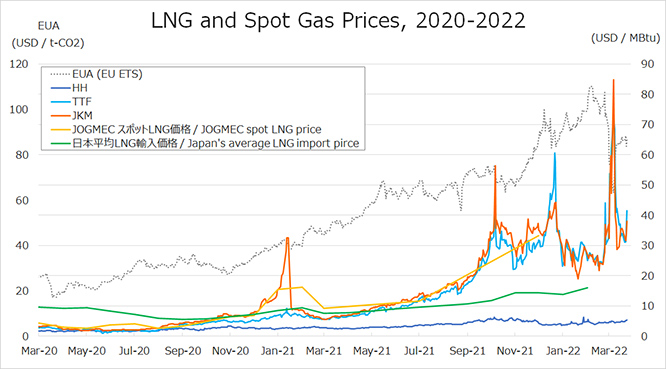

In the early morning, the front-month drove up 40 cents, officially surpassing the previous market cycle high of $4.929/MMBtu from 2018.

Currently, the high for today’s morning rally stands at $5.01/MMBtu – a remarkable seven-year high. Today’s price rally upwards was downright impressive and this type of volatility is reminiscent of the old natural gas market.

The last time an October contract surpassed our current highs was in 2008, prior to the shale revolution in a very different market. The October contract had reached a high of $8.06 back then.

Elevated market pricing today is largely the result of lower than average storage – total storage is currently at a 214 Bcf deficit to the five-year average. Concerns for winter undersupply continue to pile on, fueling the speculative nature of the market.

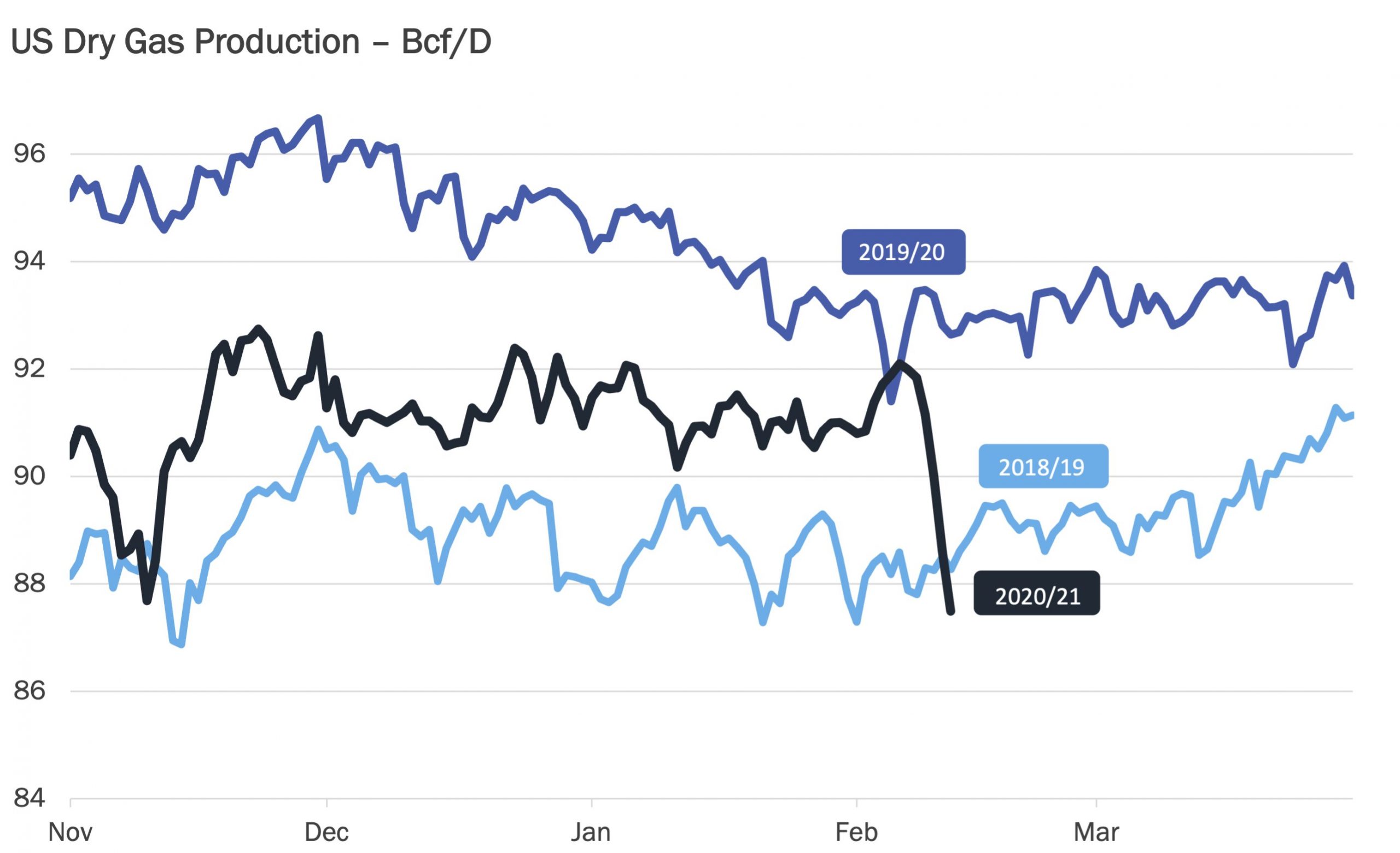

Short-term production drop-offs as a result of Hurricane Ida are still in play, with ~1.7 Bcf of Gulf of Mexico production remaining offline and unavailable to the market.

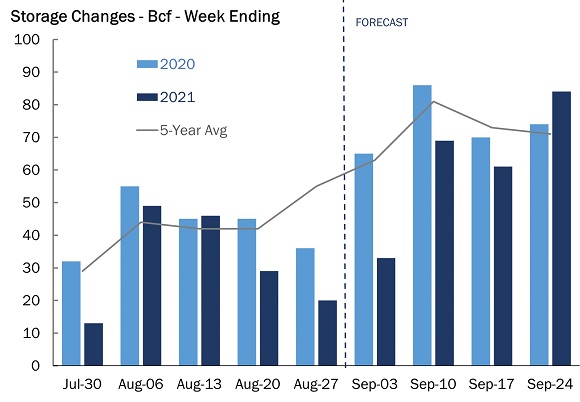

Limited supply has offset decreasing power and industrial demand through the week of storage; as a result, G&A is predicting a 33 Bcf injection.

Given that the five-year average injection is 65 Bcf, today’s price rally is a byproduct of market expectations for a low injection tomorrow.

Source: Gelber & Associates