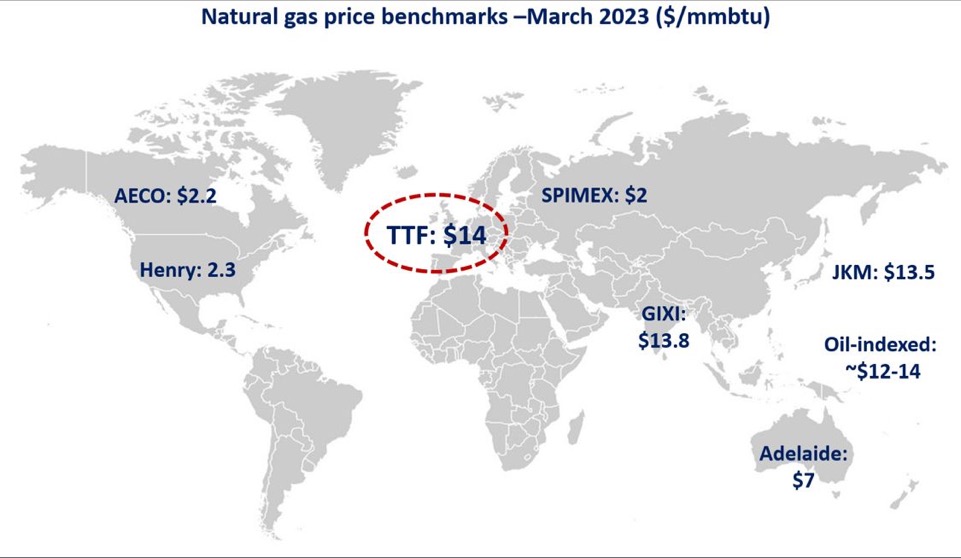

In recent weeks international gas prices have gone further into overdrive, with the Platts JKM at US$31.65/MMBtu on 28 September and the UK NBP gas price at US$29.00/MMBtu. Even US Henry Hub prices have spiked to record levels for this time of year at US$5.57/MMBtu, although well below international prices due to capacity constraints on US LNG exports.

While oil prices are increasing, reaching US$79/bbl for Brent, they still lag well behind gas prices. LNG under an oil linked contract with an 11% slope would cost a modest US$8.70/MMBtu.

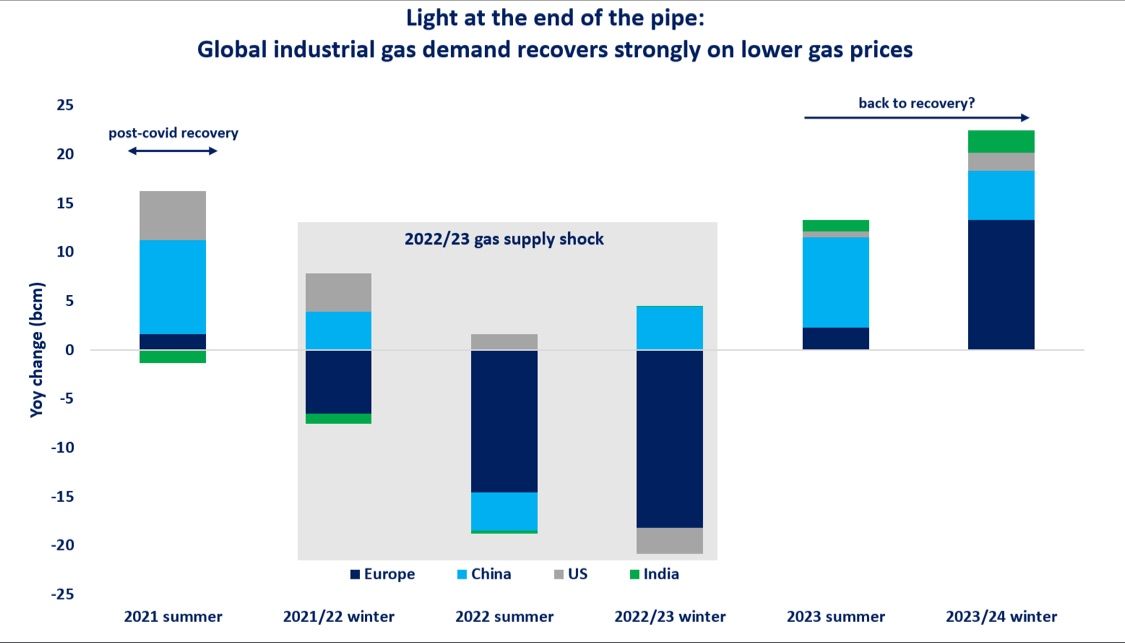

Are these elevated gas prices likely to continue? One of the major unknowns is weather, whether the coming northern winter is or isn’t warmer than expected. Along with the COVID recovery, one of the major drivers of gas prices has been last year’s colder than expected winter, which pushed up prices back in January.

Since then LNG buyers have been scrambling to replenish storage while contending with a warmer than expected summer in some countries. Weather also affects the performance of renewables and less wind in Europe and less hydro in China have also been factors increasing gas demand.

If the coming winter is warmer than expected, if the wind blows strongly in Europe, if it rains on hydro dams in China we could easily see a slump in global gas prices.

Australian gas and LNG markets still appear to be relatively unaffected by these global developments. As noted above, Australian LNG exports are largely linked to oil prices, so LNG producers are likely to do well with higher oil prices but on average earning nothing like LNG spot prices. However any spot cargoes are likely to earn mega-millions.

A 70 thousand tonne cargo sold at US$30/MMBtu would earn US$110 million or A$150 million. It remains to be seen if any Australian spot cargoes go for these prices but we have heard of one Australian cargo going for over US$20/MMBtu, which would be worth over A$100 million.

Is the global gas price surge impacting the east coast domestic gas market? It is certainly impacting the ACCC Wallumbilla LNG netback estimates, calculated on 16 September as A$22.18/GJ for October 2021, a price which no domestic gas buyer could afford. However, and counter to economic theory, domestic short-term prices are still A$7-9/GJ, reflecting lower domestic gas demand for power generation rather than global influences.

Source: EnergyQuest