The Biden administration’s pause on LNG export authorization which we reported on Thursday is having far-reaching implications.

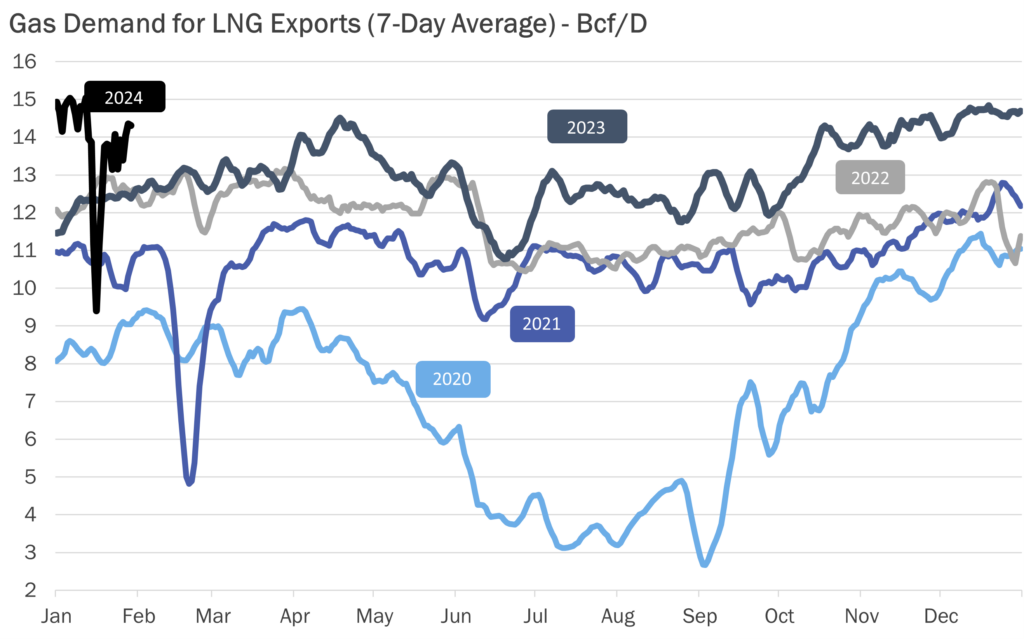

The anticipation of LNG buildout was expected to begin mainly this year, and has been not only a hugely bullish narrative in the market for some time now but a key decision-making factor for massive amounts of investment capital across the sector; most recently, Southwestern’s CEO Bill Way was quoted as saying “Our collective positioning for the substantial near-term increase in natural gas from LNG, which we’d all talk about a lot, created some impetus to move” when speaking about the company’s merger with Chesapeake.

A pause on authorization of exports may also affect plans for new liquefaction terminals and expansions as dealmakers review their outlook on the sector.

Pending LNG projects and existing supply agreements, like those of Chesapeake and EQT, could be impacted, although analysts note that delays rather than cancellations, are the more likely impact of the White House’s decision on such agreements.

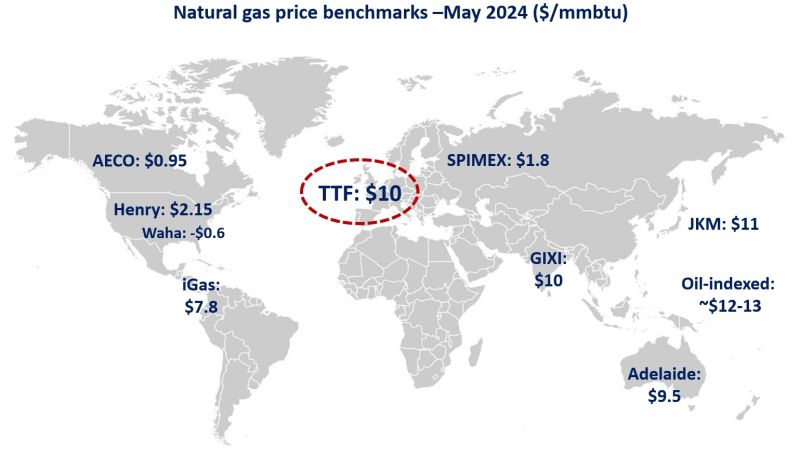

Senior industry figures have widely condemned the pause on LNG exports, citing LNG’s ability to allow countries to reduce emissions through coal-to-gas switching, as well as its ability to provide high-demand regions like Europe energy security, which reduces their reliance on energy from adversarial sources like Russia.

A dissenting opinion on the impact of the decision was recently voiced by Assistant Energy Secretary Brad Crabtree at the Baker Hughes annual meeting in Florence, Italy.

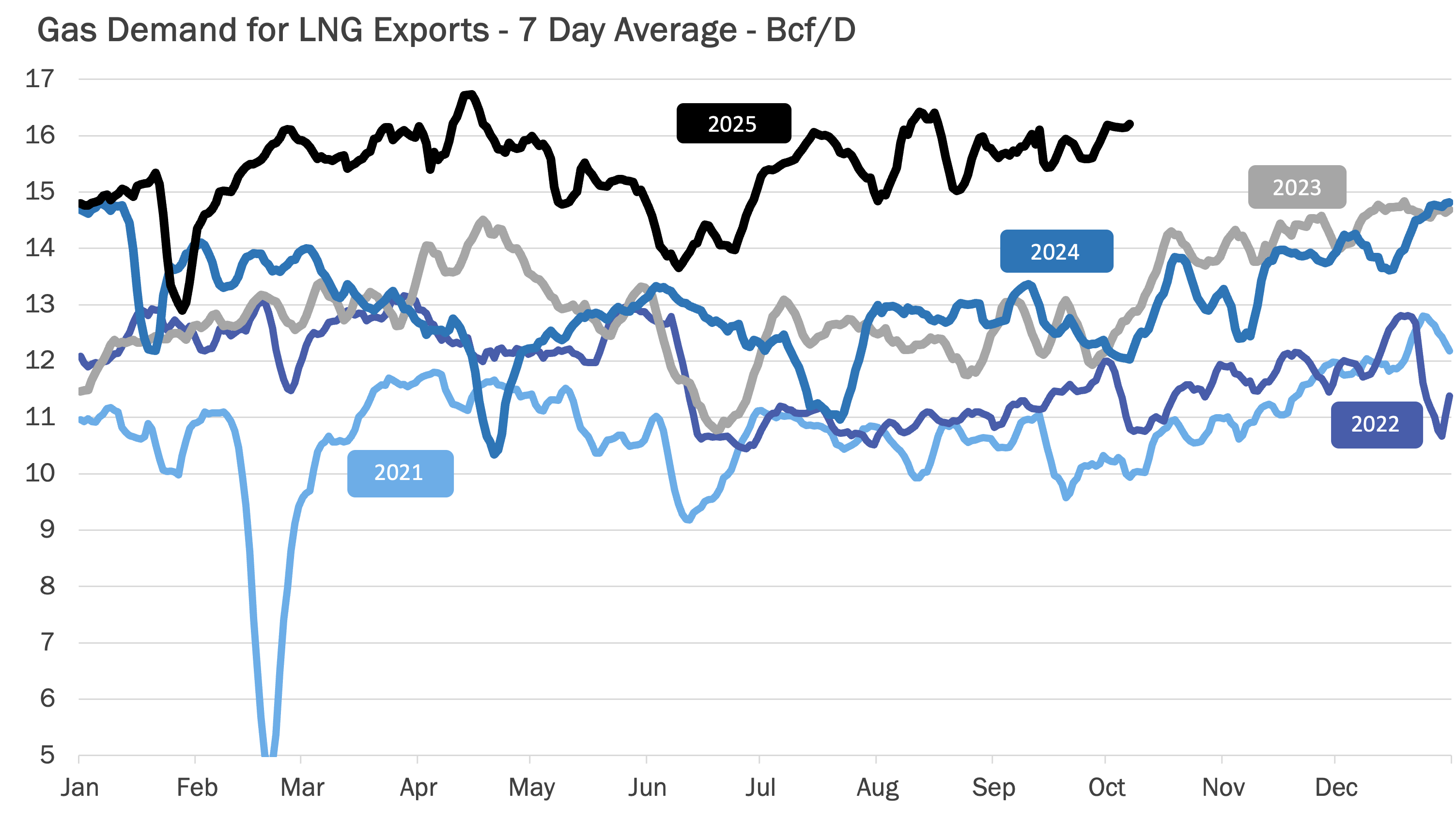

The official stated a need for a fresh look at the sector due to climate implications, arguing that an up-to-date perspective could prove useful in responding to criticism of the industry by the general public or others. Crabtree also emphasized how long-term LNG output would remain substantial even with the pause in place, noting that the US has already authorized exports exceeding current levels fourfold and expects to surpass Qatar’s exports by 2030.

The meeting’s audience, which included the president of the API and the CEO of Cheniere, remained unconvinced that the decision is net-positive.

Gelber and Associates