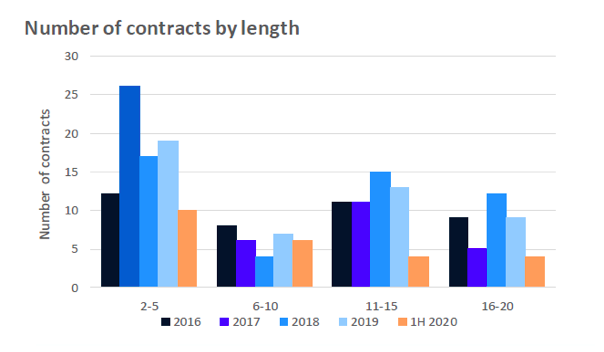

(Poten & Partners) Defying most expectations, LNG contracting during the past six months has soared compared to the same period in 2019. At least 24 contracts covering nearly 24 MMt/y of volume were signed in the first half of 2020, compared to just 14 contracts for 13.1 MMt/y signed during the first half of 2019.

Even more surprising is the fact that most of the contracts signed during the first half of the year were with sellers who were not sponsoring new projects. Buyers signed 16 contracts for 12.23 MMt/y with aggregators, traders and producers selling volumes from legacy plants for which long-term contracts have expired.

The average length of contract for these 16 contracts was six years and the average volume was just over 750,000 t/y. In addition, eight contracts for 11.75 MMt/y were signed for volumes from new projects being promoted in Mexico, the United States, Nigeria and Mauritania and Senegal. The average length of these contracts was 15 years with an average volume of just under 1.5 MMt/y.

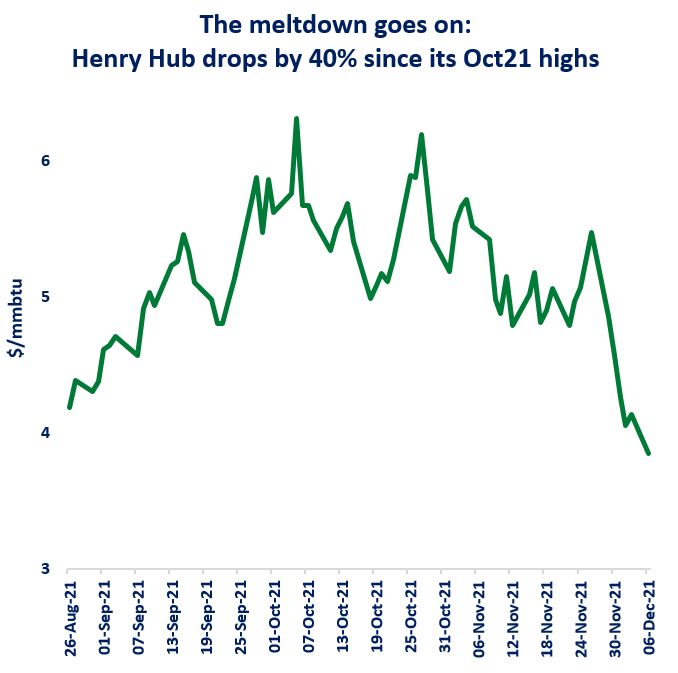

It’s safe to say that the first six months of 2020 have been among the most turbulent ever for LNG. Surpluses caused by a preexisting oversupply and a sharp drop in demand caused by the Covid-19 outbreak have led to record low prices and the cancellation of hundreds of cargoes out of the United States, Indonesia, Malaysia, Australia and other producers.

Progress on many new projects has slowed and construction at already sanctioned facilities has been delayed. The usually labor-intensive process of negotiating new contracts in face-to-face meetings has been disrupted.

Despite the headwinds, the industry has managed to forge ahead. Contract negotiations initially slowed to a crawl as economies around the world were locked down in February, March and April. However, as time went on, many buyers and sellers were able to resume discussions and eventually were able to make progress toward new deals.

Connect with & follow Poten & Partners on Twitter:

[tfws username=”PotenPartners” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]