(Dec. 7) Yesterday’s dramatic 50 cent price pullback originated from warmer weather forecasts, which accentuated the risk for lower natural gas demand in the near future. Sellers in the market transformed what was initially a strong weather forecast correction into a monstrous 11% correction into the futures markets.

Today, the front-month is no longer pushing for lower lows, but rather exploring the new price levels we have arrived at. The entire wick of yesterday’s move encapsulates the entirety of today’s early price movement.

Thusfar, price has cautiously moved upwards – around 3% – in an effort to mitigate overzealous price action from yesterday’s market rush to erase the winter risk premium. Fundamentals also support today’s early price action, with weather forecasts turning slightly colder and diminishing the impact of the weekend forecast change.

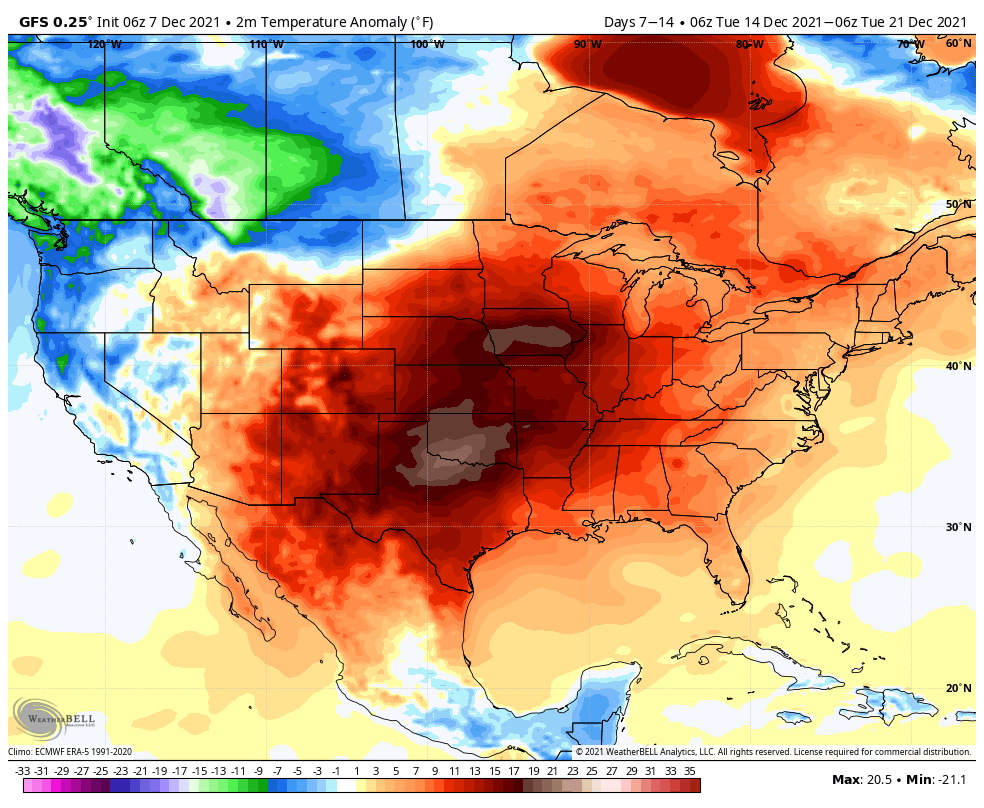

Despite the appearance of some cooler temperatures in between model runs, forecasts for the most part largely remain the same. Warmer than average temperature anomalies, as shown below, are expected to dominate Week 2, and are still expected to bring HDDs for the week far below the thirty-year average.

Source: Gelber and Associates