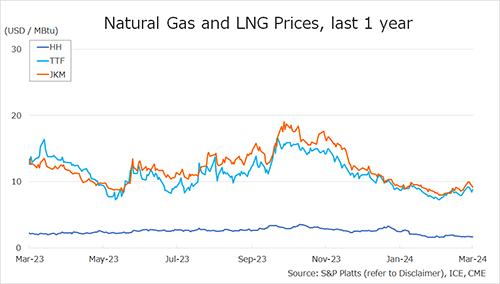

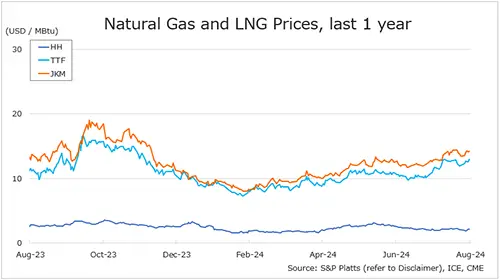

The Northeast Asian assessed spot LNG price JKM (October delivery) for last week (26 – 30 August) rose to low-USD 14s on 30 August from mid-USD 13s the previous weekend (23 August). Heightened geopolitical tensions due to the Russia-Ukraine conflict, as well as supply risks due to troubles at several projects, pushed up nearly one USD from the price previous weekend.

METI announced on 28 August that Japan’s LNG inventories for power generation as of 25 August stood at 2.06 million tonnes, up 0.13 million tonnes from the previous week.

The European gas price TTF (front-month delivery) for last week (26 – 30 August) rose to USD 12.9/MBtu on 30 August (October delivery) from USD 12.0/MBtu the previous weekend (23 August). TTF rose mainly due to reduced supply as maintenance began in Norway.

According to AGSI+, the EU-wide underground gas storage increased to 92.2% as of 30 August from 91.0% the previous weekend.

The U.S. gas price HH (front-month delivery) for last week (26 – 30 August) slightly rose to USD 2.1/MBtu on 30 August (October delivery) from USD 2.0/MBtu the previous weekend (23 August).

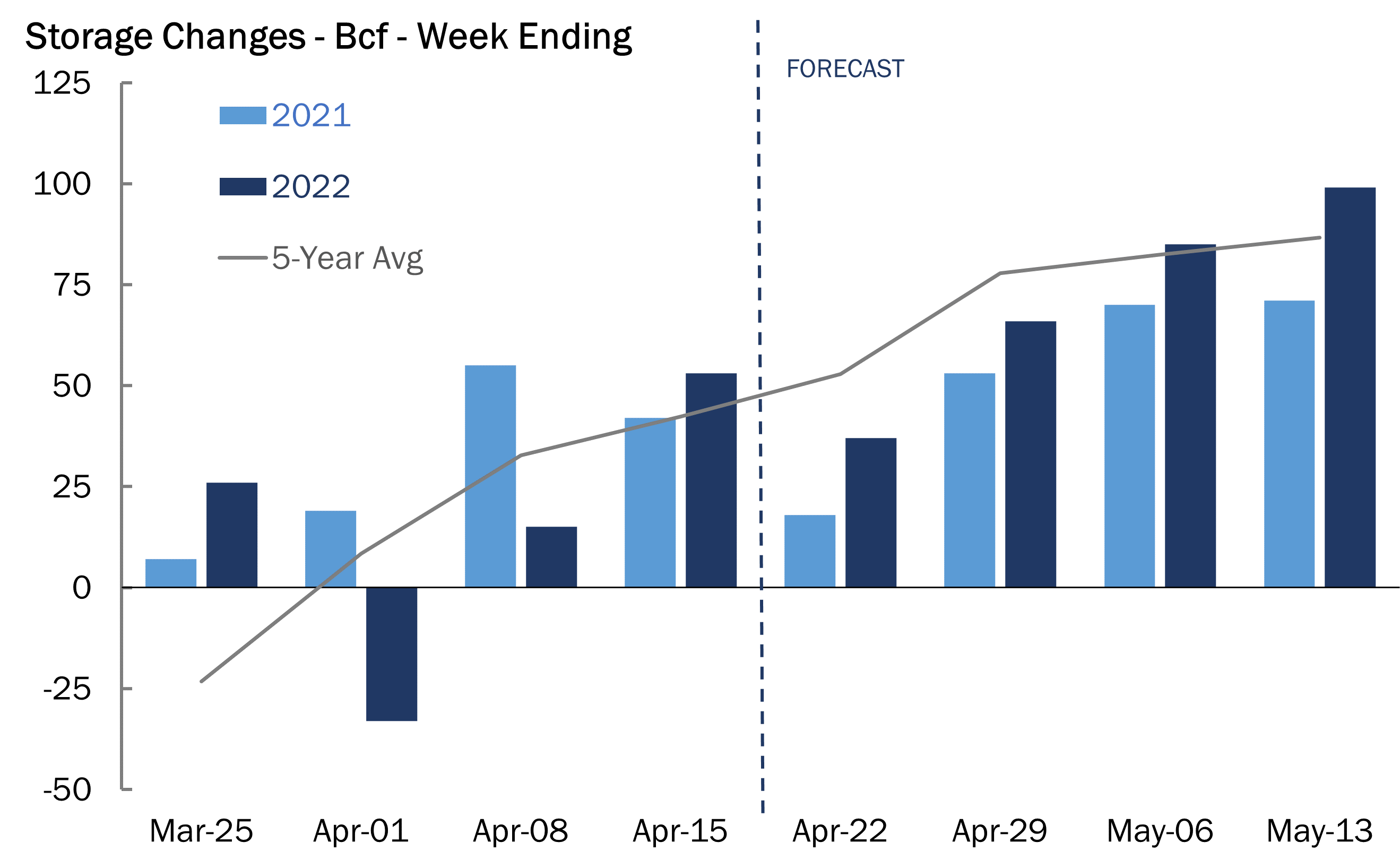

The EIA Weekly Natural Gas Storage Report released on 29 August showed U.S. natural gas inventories as of 23 August at 3,344 Bcf, up 35 Bcf from the previous week, up 7.3% from the same period last year, and 12.1% increase over the five-year average.

Updated: September 2

Source: JOGMEC