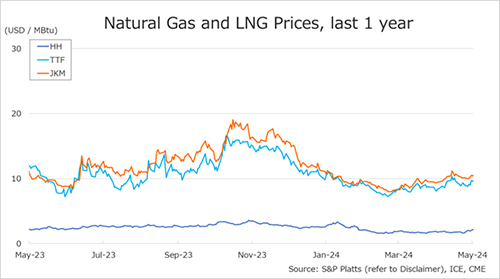

The Northeast Asian assessed spot LNG price JKM for last week (3 June – 7 June) fell to high-USD 11s on 7 June from mid-USD 12s the previous weekend (31 May).

In the beginning of the week, the price rose high-USD 12s due to supply concerns from the shutdown of Nyhamna gas plant in Norway on 2 June. After that, the price was downtrend due to restoring from its concerns and recoveries of the troubles of the Gorgon and Brunei LNG.

METI announced on 5 June that Japan’s LNG inventories for power generation as of 2 June stood at 2.23 million tonnes, up 0.17 million tonnes from the previous week.

The European gas price TTF for last week fell to USD 10.6/MBtu on 7 June from USD 10.9/MBtu the previous weekend (31 May). Although the price rose to USD 11.4/MBtu at the start of the week on supply concerns from the shutdown of the Nyhamna gas plant in Norway, it had a limited impact and was on a downtrend throughout the week.

Gassco announced that the maintenance of the plant completed on June 7. According to AGSI+, the EU-wide underground gas storage increased to 71.4% as of 7 June from 70.0% the previous weekend.

The U.S. gas price HH for this week rose to USD 2.9/MBtu on 7 June from USD 2.6/MBtu the previous weekend (31 May). It was likely to be due to 0.7Bcf drop in gas supply in the week to 5 June.

The EIA Weekly Natural Gas Storage Report released on 6 June showed U.S. natural gas inventories as of 31 May at 2,983 Bcf, up 98 Bcf from the previous week, up 14.8% from the same period last year, and 25.1% increase over the five-year average.

Updated: June 10

Source: JOGMEC