2020 has spawned an abundance of talk, speculation and indeed policy statements on hydrogen. FOMO (fear of missing out) has taken over and governments, investors, utilities, technical and professional services providers alike have been busy looking for ways to plant their flag on this new territory.

However, we have been here before – this is not the first time that hydrogen has been touted as the future of energy. In the wake of the first oil crisis in the 1970s western governments began looking at alternatives to oil. Hydrogen was seen as a perfect alternative produced from plentiful, safe and cheap nuclear energy.

However, following the Three Mile Island nuclear accident, and the world adjusting to higher oil prices, the grand plans for the hydrogen economy were quietly shelved. In the 2000s, we saw a resurgence of enthusiasm, particularly for hydrogen as a transport fuel, only to find that by the end of the decade, battery electric vehicles were rapidly winning the technology race and hopes for hydrogen faded.

Today the driver for renewed interest in hydrogen is not energy security but climate change mitigation. The technical solution of hydrogen has found a new problem to address, but so far the challenges to its commercialisation have not received sufficient attention.

Hydrogen has the clear advantage over fossil fuels of being carbon free. However, the impediments that faced its adoption in the past remain: naturally occurring elemental hydrogen is very scarce on Earth and so it must be manufactured; it has a low energy density compared with fossil fuels; there is very limited infrastructure to produce, transport and consume it; and it is currently extremely expensive to produce whether from natural gas or through electrolysis.

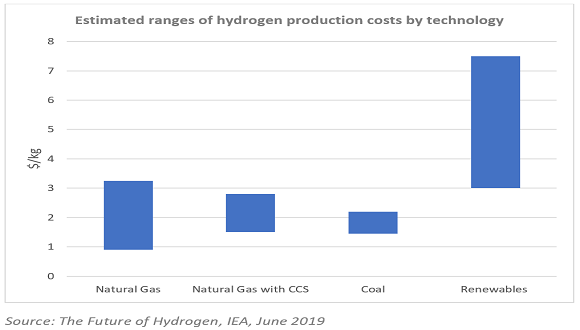

The costs of producing green hydrogen using electrolysis today in the US and Europe would be (at the lower end) between $4.00 and $4.50 / kg which is equivalent to $30/MMBtu, 10 times the current US natural gas price and 6 times the current European price. It would need a European ETS price of over €300/tonne – 10 times the prevailing price in 2020 – just to levelise the cost of hydrogen with natural gas today.

Estimated range of hydrogen production costs by technology

We may accept conventional wisdom that the costs of producing hydrogen will fall as technology develops and the industry matures, as seen elsewhere in the energy industry with the huge drop in the cost of some technologies used in renewable electricity generation.

That said, it is likely to be a long time before hydrogen can compete on a purely economic basis with fossil fuels, even allowing for the rise in carbon prices expected by many industry players. So some form of subsidy or government compulsion will be required to make hydrogen projects a reality.

Source: Gas Strategies

Follow on Twitter:

[tfws username=”GasStrategies” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]