Russia has now officially cut off natural gas supply to Poland and Bulgaria. The move was predicated upon the refusal of both countries to pay for their long-contracted gas deliveries in rubles.

As payments by other countries near their due dates, many ask whether this is the time when Russia may cut its gas deliveries to Europe completely and, if so, what can the U.S. do?

We explored the issue in depth in Send Lawyers, (Gas) & Money: Strategic Response Options if Russia Cuts Gas Supplies to Europe, published shortly before Russia’s invasion of Ukraine.

We and our co-authors concluded there that market forces, together with cogent political leadership, could be sufficient to mount a “GasLift” similar in spirit to the Berlin airlift of 1948-1949 and supply Europe with sufficient natural gas to get through the immediate winter crisis and into a period when policy decisions could be made for the future. Those conclusions have been validated.

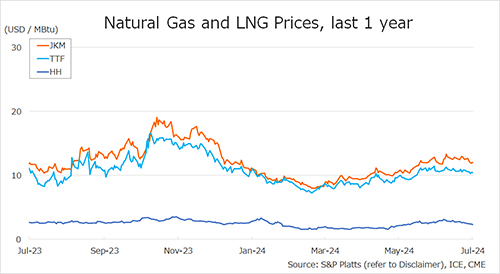

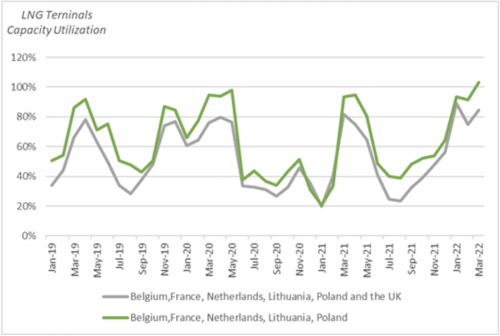

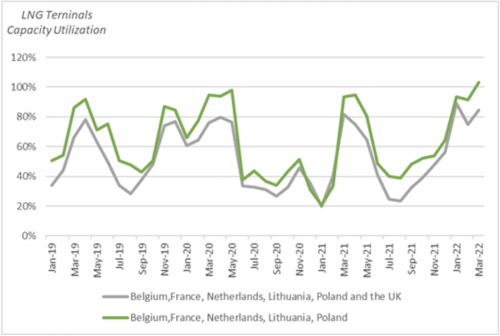

Yet, some commentators have recently called for more drastic steps, including invoking the Defense Production Act to force U.S. LNG producers to re-direct LNG cargoes to Europe. Such action at this time would, in our view, be counterproductive, harmful to U.S. trade policy and unnecessary. Indeed, even without any such drastic governmental action, most northern European LNG terminals are already running at over 100% capacity (see Figure 1) with Poland currently at 117% capacity. Why should we break a model that is working for both the U.S. and Europe?

Figure 1. LNG Terminals Capacity Utilization

Data Source: Cedigaz; authors’ analysis

For Poland and Bulgaria, the decision not to accede to Gazprom’s demand to alter their contracts to allow for conversion of their payments into rubles may have been somewhat easier than it would be for other countries. Both countries have been preparing to end their long-term contracts with Russia completely at the end of this year and have been well on the way with ensuring adequate supplies from alternative sources.

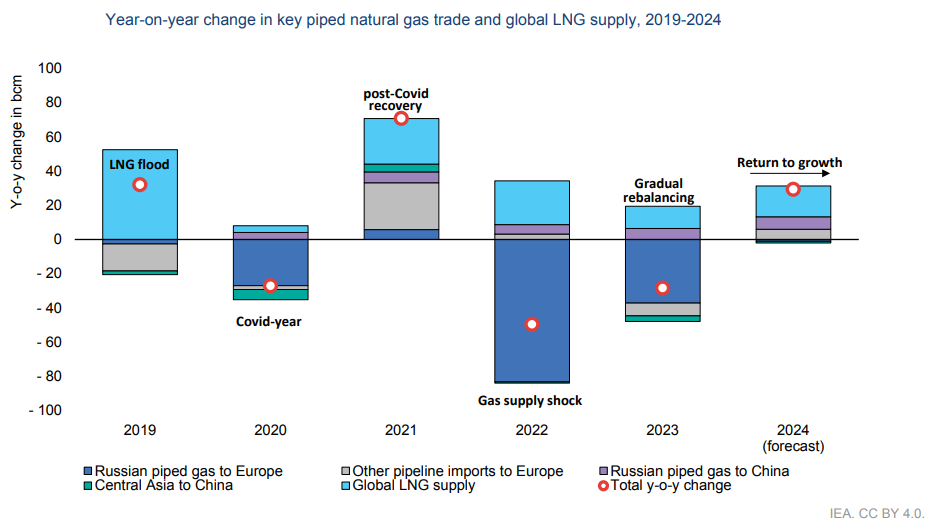

The wake-up call started in 2021 when Russia began delivering significantly less gas than usual despite higher-than-average European demand. Russia’s invasion of Ukraine only added to the sense of urgency. In fact, Poland’s advance preparation has enabled it to keep its gas storage at extremely high levels — a staggering 76% at the end of the heating season.

A similar decision will be much more difficult for countries such as Germany, Austria or Italy, which have not made similar adjustments to provide for an immediate alternative to Russian gas. This could be especially problematic in the cases of Germany and Italy, Gazprom’s largest EU customers. Each of them is currently scrambling to ensure possible non-Russian supply from different sources, including installing LNG floating storage and regasification units (FSRU)s by end of this year at their shores and trying to bring in more gas via pipeline from Algeria (in Italy’s case).

As discussed in another recent Baker Institute policy brief, A Bridge Over Troubled Water: LNG FSRUs Can Enhance European Energy Security, FSRUs are a valuable asset in meeting energy security needs while maintaining climate policy flexibility.

However, since none of these steps would be sufficient to solve an immediate and complete gas cutoff by Russia, other resources would need to be involved.

As we point out in Send Lawyers, (Gas) & Money, both LNG markets and immediate practical measures can make potential cutoff of Russian gas manageable in the short term; especially now, at the end of the heating season when natural gas demand drops significantly. And while, on average European gas storage is nowhere close to the Polish levels, it still is at levels that fit within the average at this time of the year (in the 30s%) and could be used to supply gas for immediate needs.

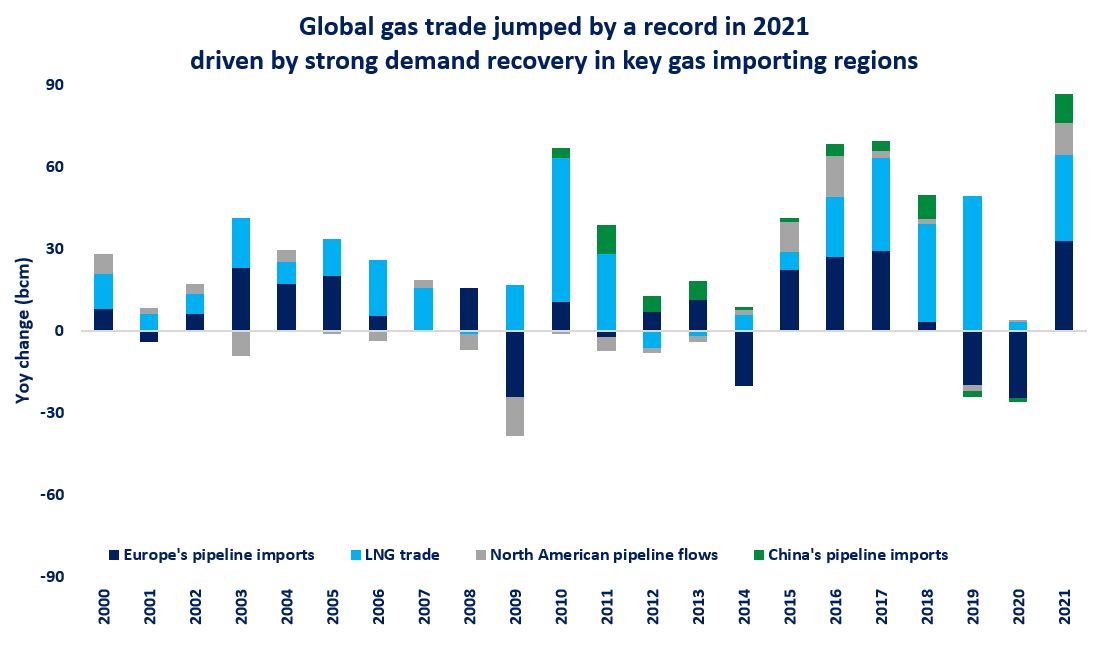

That being said, storage is supposed to be filled and not emptied at this time of the year and any lack of Russian gas supply will further stress the European system. Since the undelivered Russian gas has nowhere else to go (at least until Russia builds a new pipeline to China), the situation can reverberate globally, hiking up prices as Europe will need to compete for LNG against Asia.

Will there be enough LNG and will prices be acceptable for Europe to secure enough gas to prevent inadequate gas supply for next winter? After all, Asian buyers are known for their resolve in filling their storage and did so last summer at the time when European buyers were not willing to pay what they at that time considered high summer prices.

This is the point where some commentators have suggested that the U.S. should become even more actively involved, forcing U.S. LNG suppliers to divert supplies to Europe. The U.S. government should, they argue, employ the Defense Production Act or other legal means to direct producers of LNG in the U.S. to “breach” their contracts and deliver LNG cargoes to Europe.

While we acknowledge the possibility of direct governmental action in Send Lawyers, (Gas) & Money, particularly in the event of active war directly involving the United States and NATO, we stress that such actions at this time would be counterproductive, damaging to U.S. trade interests, and wholly unnecessary.

LNG supplies from the U.S. are already inherently flexible; deliveries are typically made at the loading terminal with the customer taking title and control at that terminal on a vessel of the customer’s choosing.

Aside from avoiding a handful of sanctioned countries, there are no restrictions on the destination to which the customer may take the cargo, and no requirement that the customer share with the LNG producer any of the higher price the customer may achieve by diverting the cargo.

This flexibility resulted in a flood of U.S. cargoes being redirected to Europe this past winter in the run-up to and during the initial invasion of Ukraine without the need for direct action by the U.S. government. Such flexibility in long-term contracts is unusual in the LNG industry, and customers worldwide have been attracted to this feature, helping to make the U.S. the world’s largest LNG exporter.

From a political risk perspective, billion-plus dollar investments to secure LNG from the U.S. remain attractive relative to other regions, largely because they are commercially-centered with little government interference. In fact, the U.S. government has never terminated an export license for an operating LNG export project.

To force U.S. LNG producers to breach their contracts now would forever tarnish that reputation, and could have a serious and deleterious impact on investment in future LNG projects that would otherwise provide precisely the kind of flexible LNG supply that came to Europe’s rescue just a few months ago.

In addition, there are national security and trade agreement issues with the U.S. government unilaterally breaking contracts for LNG shipments to allies and trade partners outside of Europe.

Beyond being counterproductive and poor trade policy, such an action is also wholly unnecessary. According to Cedigaz data, northern European LNG import terminals – those in the area most affected by a cutoff of Russian natural gas — operated on average at over 100% of nameplate capacity in March 2022 (see Figure 1 above). Poland’s terminal operated at 117%. However, LNG terminals in the U.K. operated at only 59% in March.

Officials from the U.S. and U.K. governments have reportedly discussed making available LNG supplied to the U.K. to continental Europe, but opportunities to do so in the short term are limited. The U.K. is connected by pipelines to Belgium and the Netherlands that are already in use; combined, their capacity of 3.75 bcm/month adds only 5.5% to the volume of LNG being processed at all northern European LNG terminals on the continent.

The U.K. has discussed re-exporting, or even “shuttling,” LNG from its terminals to terminals in Europe, but as shown above, those European terminals are already operating well above capacity and new FSRUs are not scheduled to be on station for several months or longer. Even as FSRUs are added, they are likely to bring helpful, but incremental, capacity online, and there is no reason to think that the current system that has brought so much LNG to Europe cannot meet the additional demand that a half-dozen publicly-announced FSRUs will require.

It is possible that Europe will invest substantially in more onshore and offshore natural gas infrastructure and their LNG demand will grow dramatically beyond its current level. Until then, forcing U.S. LNG producers to redirect more cargoes to Europe begs the question – if breaking the flexible and reliable U.S. LNG contracting model cannot actually push more LNG into Europe than Europe is able to take, what is the benefit of breaking the model?

Here is where U.S. gas diplomacy can become more important and valuable than regulatory mandates interfering with private contracts. We have seen it already working in 2022 and we are likely to see it again now that the risk of either partial or even complete Russian gas cutoff has become that much greater.

Government suasion can and should be directed at many actors, including by Europeans to increase their gas production and purchases from Groningen, Norway and Algeria, arrange for immediate LNG infrastructure buildup through FSRUs, shorten permitting times for all energy infrastructure (including the current seven years for new wind projects), and encourage fuel switching and even involve gas rationing.

The U.S. government can work with other LNG producers (like Qatar, Nigeria and Australia) to make their cargos more flexible when it comes to destination and work with large LNG buyers in Asia at ensuring that European gas supply security is retained – all steps that can make a difference without direct intervention in U.S. gas sales contracts. Such intervention, though possible, should be reserved for very unique circumstances and after exhausting the full extent of all soft power measures available to achieve its goals.

Only then should the U.S. consider moving to more direct intervention. We posit that such intervention at this time would be counterproductive to meeting future needs for flexible supply to Europe and elsewhere and damage the U.S. trade relationships.

Moreover, the success of the “GasLift” over the last few months has demonstrated that such intervention is not necessary and would be unlikely to bring any incremental benefit to Europe, where terminals are already full with LNG from the U.S. and elsewhere.