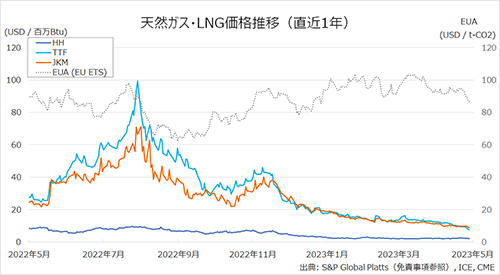

The Northeast Asian assessed spot LNG price JKM for the previous week (22 May – 26 May) fell from the high USD 9s the previous week to the below USD 9/MBtu on 26 May, trending lower due to continued low demand and high inventory levels in Northeast Asia, after a slight up and down.

According to METI, Japan’s LNG inventories for power generation totaled 2.50 million tonnes as of 21 May, down 0.11 million tonnes from the previous week, up 0.39 million tonnes from the end of the same month of last year and up 0.49 million tonnes from the average of the past five years.

The European gas price TTF fell for five consecutive days from USD 9.6/MBtu the previous week to USD 7.7/MBtu on 26 May, amid firm underground gas storage volumes and weak demand.

With the widening price spread between winter and summer, the market participants expect further storage injections during summer to fill up before winter.

ACER published the 26 May spot LNG assessment price for delivery in the EU at EUR 25.3/MWh (equivalent to USD 8.0/MBtu).

According to AGSI+, the European underground gas storage rate as of 26 May was 67.3%, up from 65.1% the previous week.

The U.S. gas price HH fell slightly to USD 2.2/MBtu on 26 May from USD 2.6/MBtu the previous week, after a slight up and down.

According to the EIA Weekly Natural Gas Storage Report released on 25 May, the U.S. natural gas underground storage on 19 May was 2,336 Bcf, up 96 Bcf from the previous week, up 29.3% from the same period last year, and up 17.0% from the historical five-year average.

Updated 29 May 2023

Source: JOGMEC