In other news, potential LNG projects continue to have supply bought out – China gas has agreed to purchase 700,000 mt of gas per year from Energy Transfer’s Lake Charles facility.

Gunvor, ENN NG, and SK Gas all have SPAs currently in place with Lake Charles; this latest agreement brings up the total amount of gas purchased to 5.8 MTPA, ~46% of the overall capacity of size of the planned terminal.

There are already a large number of LNG projects that are in the development pipeline and to some degree, it will be impossible for all of them to come online at the same time without a significant increase in production.

Lake Charles, Rio Grande, Driftwood, Commonwealth LNG, and Corpus Christi Stage 3 are just a few of the known names that have SPAs currently in place, but lack FID.

In the unlikely event that all these facilities are built to completion, US LNG export capacity would leap beyond 28 Bcf/D by 2027. For the record, current LNG capacity is noted at around 13 Bcf/D, as Calcasieu Pass continues to ramp online.

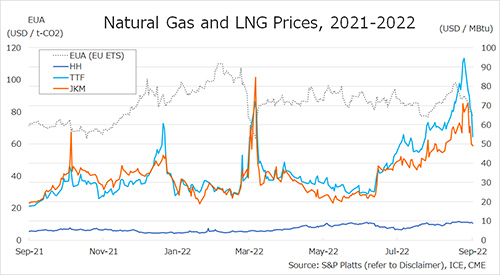

In the current environment, where a wide arbitrage between the Henry Hub and international benchmarks exists, it is easy to imagine sizeable profits for any LNG facility built.

However, in two-three years time, when all of these potential projects are built alongside each other and domestic to international spreads have narrowed, the profitability of these terminals will likely suffer as they are forced into competition with each other for a limited gas supply.

source: Gelber and Associates