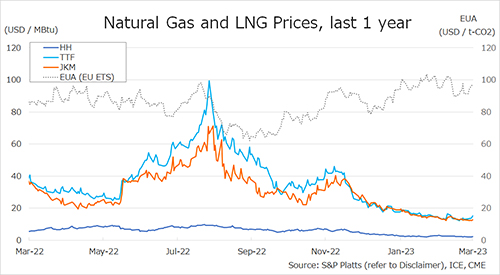

The Northeast Asian assessed spot LNG price JKM for the previous week (27 March – 31 March) fell for the second consecutive day to USD 12/MBtu on 28 March from late USD 12s in the previous week due to weak demand and stable supply in the Northeast Asian region.

JKM then rose to the late USD 12s on 29 March, fueled by a series of European gas price hikes, but fell to USD 12/MBtu on 30 March due to weak demand and high inventories in the Northeast Asian region.

The following day, 31 March, JKM also rose on the back of higher European gas prices, hitting the late USD 12s. According to METI, Japan’s LNG inventories for power generation totaled 2.29 million tonnes as of 26 March, down 0.27 million tonnes from the previous week, up 0.66 million tonnes from the end of the same month last year and up 0.22 million tonnes from the average of the past five years.

The European gas price TTF rose for four consecutive days to USD 13.9/MBtu on 30 March, from USD 12.9/MBtu the previous week, mainly due to the decision to extend the strike at French LNG terminals.

On 31 March, TTF rose to USD 15.2/MBtu on the back of the further extension of the strikes at the French LNG terminals and higher demand due to cooler temperatures.

On 28 March, EU energy ministers added a security clause allowing member states to take proportionate measures to temporarily limit imports of gas and LNG from Belarus and Russia in the new EU gas market rules.

They also agreed to extend the voluntary 15% gas demand reduction target by one year to the end of March 2024 (the European Council formally adopted the extension on 30 March).

ACER published the 31 March spot LNG assessment price for delivery in the EU at EUR 38.27/MWh (equivalent to USD 12.2/MBtu). According to AGSI+, the European underground gas storage rate as of 31 March was 55.7%, down from 55.8% the previous week.

The U.S. gas price HH fell for three consecutive days from USD 2.2/MBtu the previous week to USD 1.991/MBtu on 29 March, due to limited demand and stable supplies caused by mild weather.

The April front-month settled below USD 2.0/MBtu, its lowest since July 2020. The next day, the HH May front-month contract settled at USD 2.1/MBtu, down from the prior settlement, and on 31 March, it was slightly higher at USD 2.2/MBtu.

According to the EIA Weekly Natural Gas Storage Report released on 30 March, the U.S. natural gas underground storage on 24 March was 1,853 Bcf, down 47 Bcf from the previous week, up 31.3% from the same period last year, and up 21.0% from the historical five-year average.

Updated 03 April 2023

Source: JOGMEC