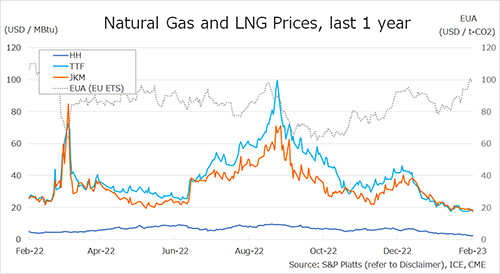

The Northeast Asian assessed spot LNG price JKM for the previous week (30 January – 3 February) remained flat on 30 January from the high USD 18/MBtu on the previous week due to weak prompt cargoes demand and high inventory level despite colder temperatures, and then rose to the low USD 19/MBtu next day, fueled by higher European gas prices.

The price fell to USD 18/MBtu on 1 February due to stagnant procurement activities in China after the Lunar New Year but rose to USD 19/MBtu on 2 February as India and other South Asian countries resumed procurements.

The next day, on 3 February, reports related to the planned restart of Freeport LNG in the U.S. caused spot cargoes to be bought down and JKM fell to USD 18/MBtu.

According to METI, Japan’s LNG inventories for power generation totaled 2.53 million tonnes as of 29 January, down 0.17 million tonnes from the previous week, up 0.73 million tonnes from the end of the same month last year and up 0.86 million tonnes from the average of the past five years.

The European gas price TTF was flat on 30 January from USD 17.6/MBtu the previous week. It then rose for two consecutive business days to USD 19.0/MBtu on 1 February following forecasts of cold weather and reports of extended unplanned repairs at Norwegian gas facilities, but fell to USD 18.4/MBtu the next day.

On 3 February, TTF rose to USD 18.6/MBtu due to delays in the restart of French nuclear reactors. ACER published the 3 February spot LNG assessment price for delivery in Northwest Europe at EUR 53.81/MWh (USD 17.25/MBtu), down EUR 0.96/MWh from the previous week.

According to AGSI+, the average European underground gas storage level as of 3 February was 69.84%, down from 74.29% the previous week.

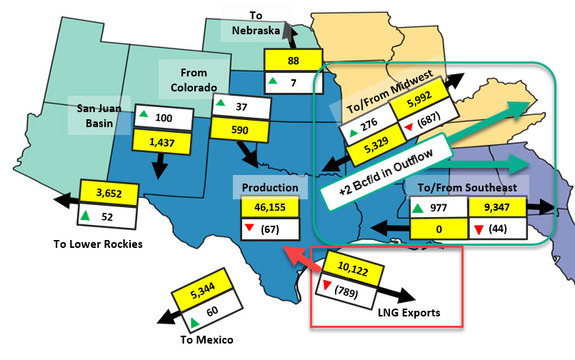

The U.S. gas price HH fell to USD 2.7/MBtu on 30 January from USD 3.1/MBtu the previous week. After leveling off the next day, it fell for three consecutive business days to USD 2.4/MBtu on 3 February on weak heating demand and strong natural gas production.

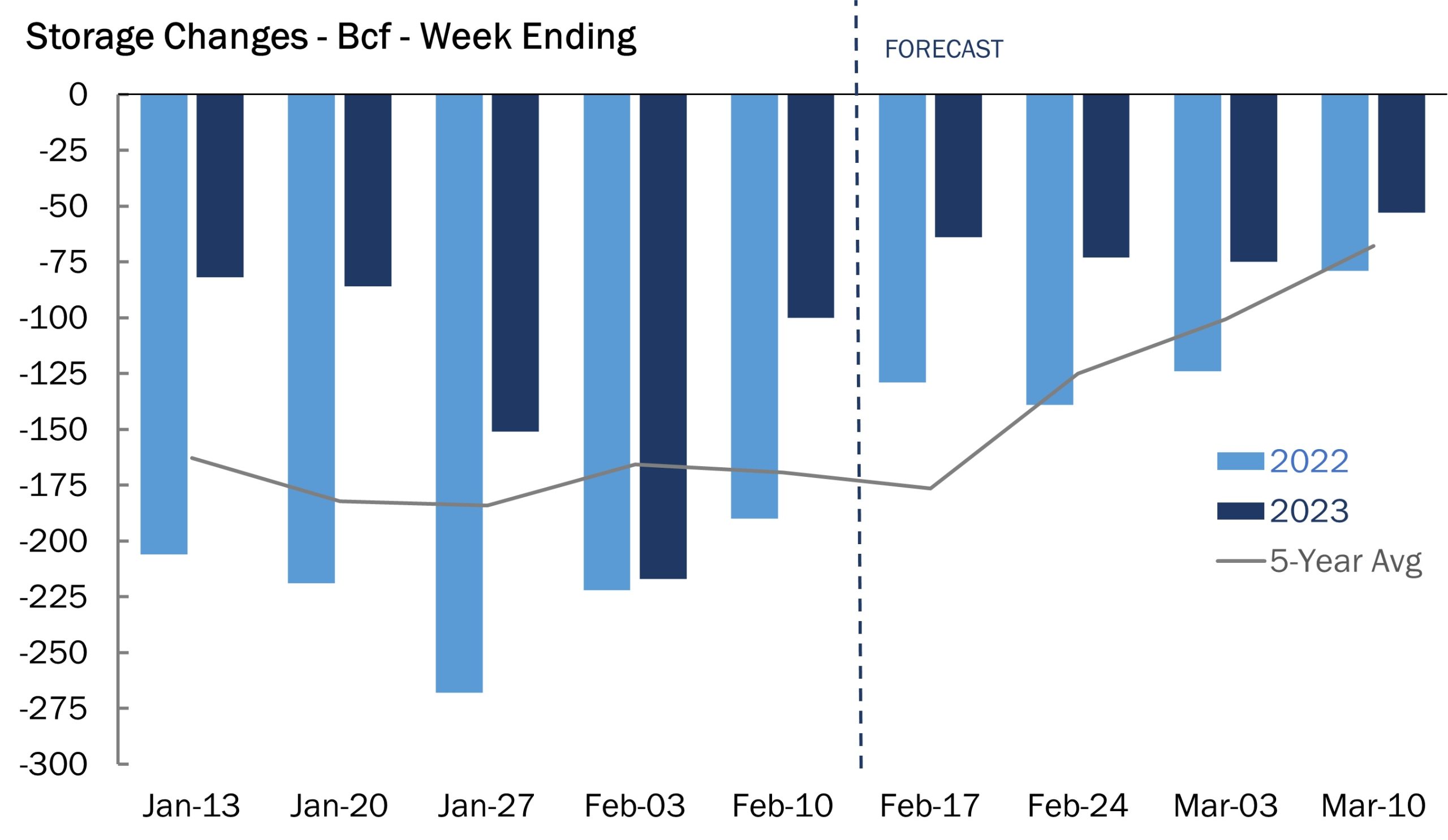

Freeport LNG filed an application with FERC on 2 February pertaining to the partial resumption of operations. According to the EIA Weekly Natural Gas Storage Report released on 2 February, the U.S. natural gas underground storage on 27 January was 2,583 Bcf, down 151 Bcf from the previous week, up 9.4% from the same period last year, and up 6.7% from the historical five-year average.

Updated 06 February 2023

Source: JOGMEC