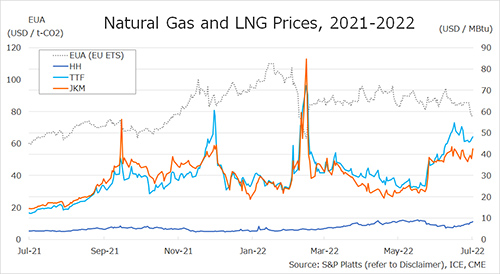

The Northeast Asian assessed spot LNG price JKM for the previous week (18 July-22 July) fell to USD 37/MBtu on 18 July from USD 39/MBtu the previous week.

JKM then rose to USD 40/MBtu on 20 July on the back of buying interest in September-October delivery cargoes mainly from Korea and Japan, but fell to USD 38/MBtu on 21 July due to the resumption of the Nord Stream 1 operations and the prospect of increased U.S. cargoes to Asia.

On 22 July, JKM was at USD 43/MBtu, fueled by rising TTF.

The European gas price TTF rose to USD 46.6/MBtu on 18 July from USD 46.0/MBtu the previous week due to gas supply concerns, but fell to USD 45.8/MBtu on 19 July.

TTF subsequently rose, rising to USD 47.2/MBtu on 21 July on concerns about a shortage of the European natural gas underground storage in winter despite the completion of annual maintenance on the Nord Stream 1 and the resumption of Russian gas supplies (40% flows, though).

On 22 July, TTF rose further to USD 48.1/MBtu due to concerns over the delayed return of the Nord Stream 1 turbine.

The U.S. gas price HH remained in the USD 7’s, from USD 7.0/MBtu the previous week, then rose to USD 8.0/MBtu on 20 July.

The prices remained high as above-normal temperature drove demand for cooling.

HH fell to USD 7.9/MBtu on 21 July and rose to USD 8.3/MBtu on 22 July.

Updated 25 July 2022

Source: JOGMEC