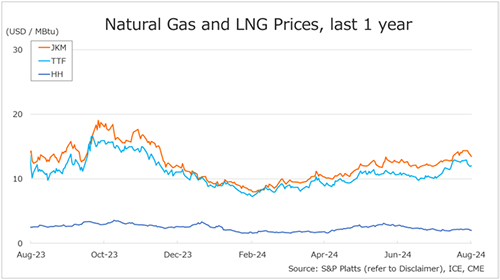

The Northeast Asian assessed spot LNG price JKM for last week (19 – 23 August) fell to mid-USD 13s on 23 August from mid-USD 14s the previous weekend (16 August).

The price rose to its highest level since the beginning of 2024 on 19 August, but since then, demand in South-East and East Asia has been weak against a backdrop of high prices and the price has generally trended lower this week. METI announced on 21 August that Japan’s LNG inventories for power generation as of 18 August stood at 1.92 million tonnes, down 0.06 million tonnes from the previous week.

The European gas price TTF for last week (19 – 23 August) fell to USD 12.0/MBtu on 23 August from USD 12.8/MBtu the previous weekend (16 August).

TTF remained high until last week, but trended lower over the week in general as geopolitical tensions tended to ease and stable supplies continued to come from Norway. According to AGSI+, the EU-wide underground gas storage increased to 91.0% as of 23 August from 89.1% the previous weekend. The EU gas storage target of 90% was achieved before November.

The U.S. gas price HH for last week (19 – 23 August) fell to USD 2.0/MBtu on 23 August from USD 2.1/MBtu the previous weekend (16 August).

The EIA Weekly Natural Gas Storage Report released on 22 August showed U.S. natural gas inventories as of 16 August at 3,299 Bcf, up 35 Bcf from the previous week, up 7.2% from the same period last year, and 12.6% increase over the five-year average.

Source: JOGMEC