To assess the success of European efforts to shift away from Russian gas, the EOA issues a monthly tracker of the EU’s external gas supplies through pipelines from Russia, Azerbaijan, Norway, and North Africa (Algeria and Libya), as well as LNG cargoes from global suppliers like the US, Qatar, and Nigeria.

The tracker aims to highlight gas import changes within the EU and how the bloc has been reducing its reliance on Russian gas.

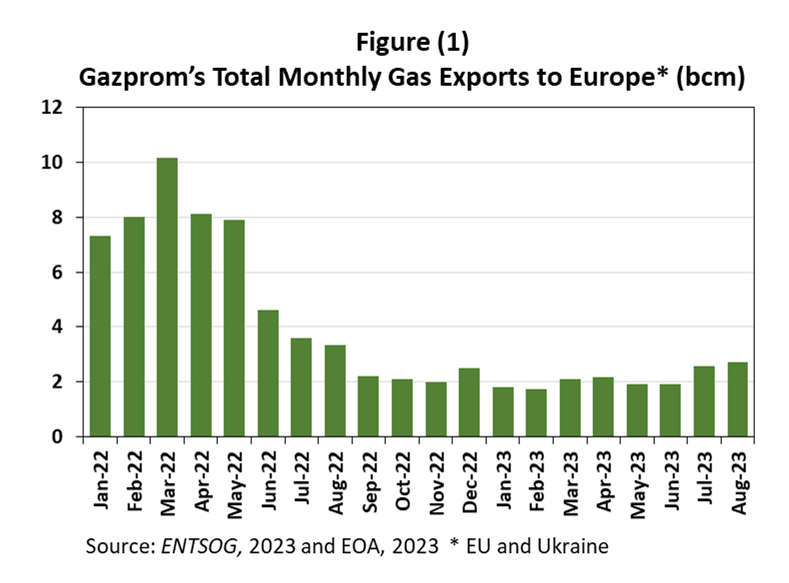

Gazprom’s gas supplies to Europe (EU and Ukraine) increased by 6.4% month-on-month in August, hitting a new record high of 2.73 billion cubic meters (bcm) in 2023, according to the EOA’s calculations, and data from the European gas transmission platform (ENTSOG).

This is the highest monthly figure since August 2022 when the Russian state-run gas giant halted its supplies through the Nord Stream 1 pipeline following an engine oil leak at the last operating turbine at the Portovaya compressor station (Figure 1).

The EOA’s data shows that Gazprom shipped 1,278 million cubic meters (mcm) of gas via Ukraine through the Sudja gas station on the Russian-Ukrainian border, of which 237 mcm of gas was offloaded in Ukraine, while the remaining volume of 1,049 mcm was shipped to EU member states.

Gazprom’s daily gas exports through the Sudja metering point averaged 41.5 mcm in August, up from 41 mcm in July.

Meanwhile, the total volume of gas Gazprom shipped in August via the TurkStream pipeline passing through Turkey jumped to an all-time high of 1,446 mcm, up from 1,297 mcm in July, an uptick of 11.5% month-on-month.

As we have been noting in our monthly report on the EU’s gas imports mix, Gazprom is aiming to increase its gas shipments via the TurkStream pipeline, with average daily gas flows currently maintained above 46 mcm.

Source: Anas Alhajji