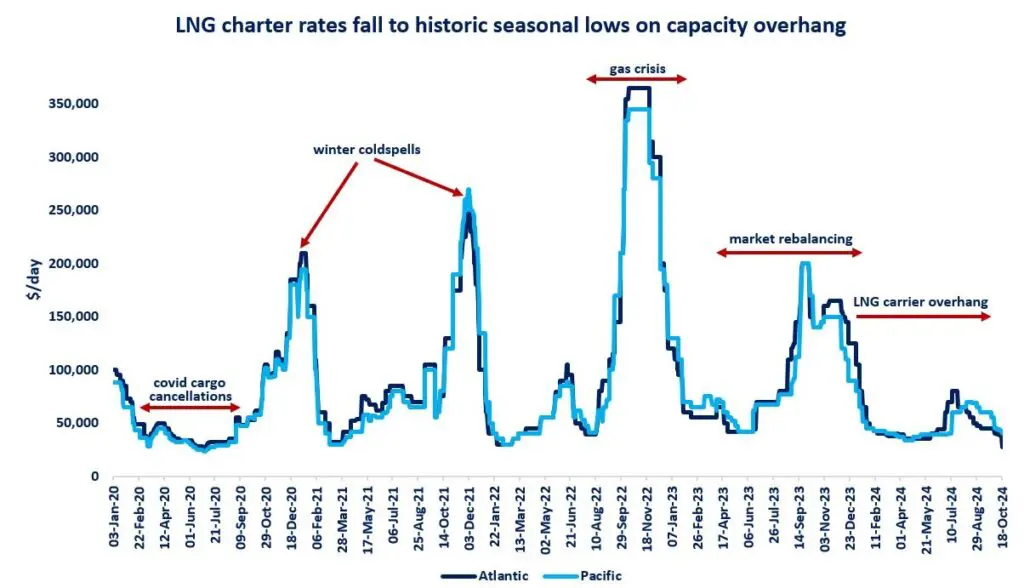

Spot LNG charter rates in the Atlantic plummeted by near 70% since mid-July, dropping to below $30k/d last week, with some vessels being chartered at below $20k/d, a historic seasonal low.

Spot LNG charter rates typically display a strong seasonal profile, similarly to gas and LNG prices, they tend to rise with the arrival of the heating season, reflecting higher gas demand and consequently stronger shipping requirements.

Charter rates hit an all-time during the 2022/23 winter, with some vessels being chartered at over $400k/d, during the most difficult days of the gas crisis. The market moved towards a gradual rebalancing since then and charter rates smoothened over 2023 summer.

The current downfall for LNG charter rates started from mid-July 2024 and reflects a temporary oversupply in LNG carrier capacity: while LNG supply grew at a mere 2%, the LNG carrier fleet expanded by around 8% compared to last year.

In addition, weak demand fundamentals in Europe (LNG imports down by 20% yoy) weighed further on LNG charter rates in the Atlantic. Spot charter rates now dropped to below $30k/d -just one-fifth of their 5y average for this period of the year.

Low spot LNG charter rates are expected to have a number of effects, including:

(1) tighter JKM-TTF spreads: lower shipping costs will naturally weigh on the JKM-TTF price spread, which already shrunk from $1.5/mmbtu in Q3 to around $0.5/mmbtu these days;

(2) floating storage: low charter rates could incentivise more floating storage to capture inter-month price spreads. Floating storage volumes rose by near 10% since end of Sep;

(3) lower costs of LNG supply: depressed charter rates are naturally reducing the cost of LNG supply, although this would not necessarily translate into lower gas or LNG prices, but rather improve the margin rates of traders with greater exposure to spot shipments.

And while the short-term outlook is bearish, these low charter rates are not expected to last long. the next LNG mega-wave through the second half of the decade (over 270 bcm/y capacity additions), will naturally provide upward support to spot LNG charter rates both in the Atlantic and Pacific basins.

What is your view? How will LNG shipping evolve this winter? What will be the impact on the market? And by when do you see charter rates improving?

Source: Greg MOLNAR