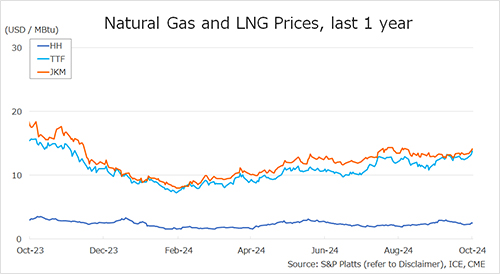

The Northeast Asian assessed spot LNG price JKM (December delivery) for last week (21 October – 25 October) rose to low-USD 14s on 25 October from low-USD 13s the previous weekend (18 October).

The price was upward trend through the week due to growing supply concerns from unplanned maintenance at the Norwegian gas field and falling U.S. feed gas supplies. JKM hit its highest since this August. Demand in Asia remains low due to high level of their stocks.

METI announced on 23 October that Japan’s LNG inventories for power generation as of 20 October stood at 2.12 million tonnes, up 0.04 million tonnes from the previous week.

The European gas price TTF (November delivery) for last week (21 October – 25 October) rose to USD 13.8/MBtu on 25 October from USD 12.5/MBtu the previous weekend (18 October). The price rose by more than one dollar due to lower temperatures in Northwest Europe and unplanned maintenance at the Norwegian gas field.

European underground gas storage also continued to be withdrawn, recording a decline for five consecutive days since 22 October.

The U.S. gas price HH (November delivery) for last week (21 October – 25 October) rose to USD 2.6/MBtu on 25 October from USD 2.3/MBtu the previous weekend (18 October). Feed gas supplies to major LNG liquefaction facilities in U.S. decreased from middle of the week but seemed to be recovered over the weekend.

On the other hand, feed gas supplies to Cameron LNG and Sabine Pass LNG remained weak.

The EIA Weekly Natural Gas Storage Report released on 24 October showed U.S. natural gas inventories as of 18 October at 3,785 Bcf, up 80 Bcf from the previous week, up 2.9% from the same period last year, and 4.6% increase over the five-year average.

Updated: 28 October 2024

Source: JOGMEC