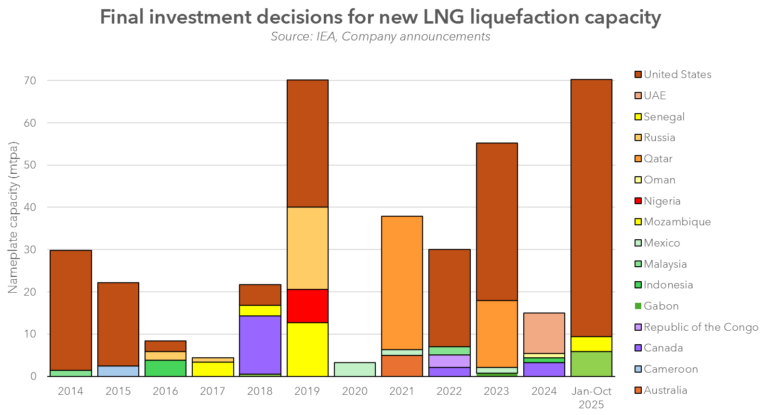

The U.S. LNG export industry is rapidly expanding, with more than 60 Mtpa of new capacity already reaching final investment decision this year — signalling a major leap in global supply.

Yet beneath this surge lies a cautionary note: project delays, cost inflation, and a high-profile arbitration ruling are starting to challenge the perception of the U.S. as the most reliable LNG supplier.

A recent tribunal decision in favour of BP over Venture Global LNG found that the Calcasieu Pass project had not been brought into commercial operation “in a reasonable and prudent” manner. For Asian and European buyers reliant on long-term contracts, the ruling raises deeper questions about delivery certainty and contract enforceability in the world’s fastest-growing LNG export region.

What happens next will shape future trade flows and procurement strategies. Buyers may push for greater contractual flexibility or diversify sourcing, while developers could face higher financing costs if confidence weakens.

With U.S. LNG potentially accounting for one-third of global supply by the 2030s, maintaining buyer trust is becoming as critical as expanding capacity.

Source: CEDIGAZ — U.S. LNG: Buyer trust amid the looming supply glut