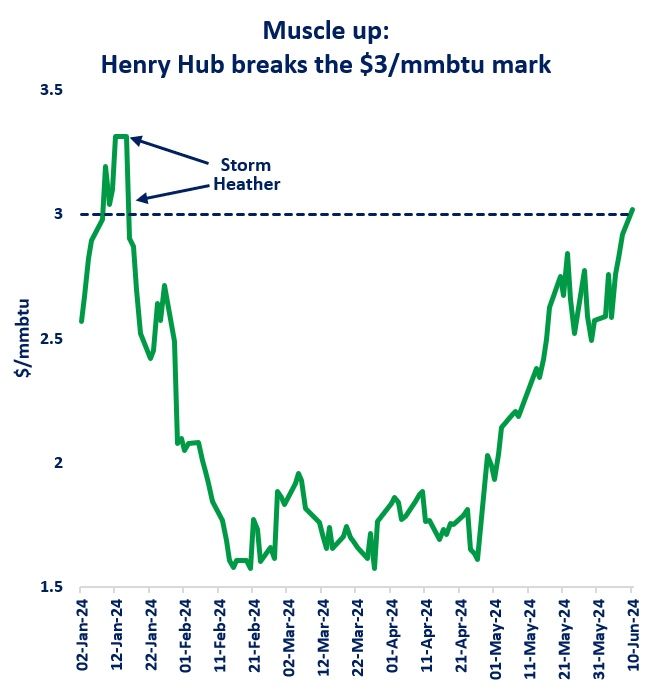

Henry Hub broke today the $3/mmbtu mark, for the first time since Storm Heather swept across the US early Jan this year.

Henry Hub prices almost doubled since their March lows, when they dropped to near $1.5/mmbtu -a multidecade low for that period of the year.

The key drivers behind this price rally are:

(1) Production cuts: US dry gas output dropped by 3% yoy in recent weeks as upstreamers started to rationalise their production in the wake of the March/April price collapse;

(2) Strong powgen demand: gas burn in the power sector was up by 6% yoy in May, supported by relatively low gas prices and high electricity demand amidst sizzling heatwaves;

(3) Strong piped exports to Mexico: up by 8% yoy last month, driven by higher gas-fired powgen in the country;

(4) US LNG at full speed: with all Freeport trains back in the game, LNG feedgas flows are adding to the overall US gas demand and provides upward support to prices.

Source: Greg Molnar